And second the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Enhanced Sum Assured means the amount if applicable as specified in the Schedule under the Policy.

Enhanced Sum Assured Meaning. The sum insured is the amount you can claim in an YEAR. Some plans have a limit to the maximum increment in the sum assured and the increment stops after the maximum limit is reached even though the plan tenure continues. Minimum Guaranteed Sum Assured on Maturity is nil for each of the above. Enhanced Sum Assured at the time of Death shall be the Basic Sum Assured increased by a simple rate of 5 per annum at each policy anniversary subject to maximum of 200 of Basic Sum Assured chosen at policy inception.

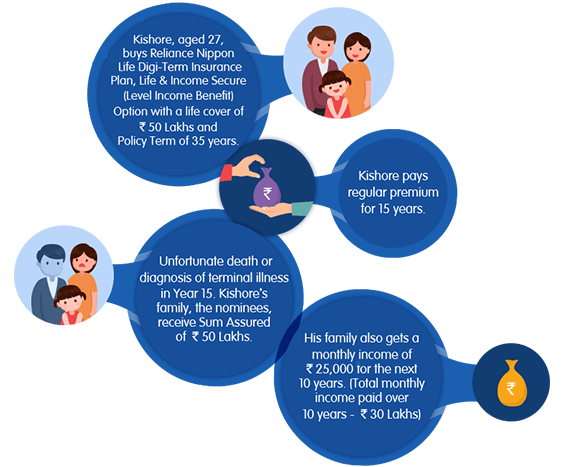

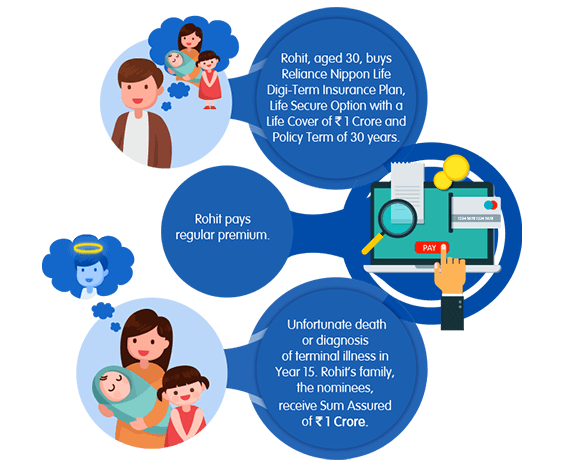

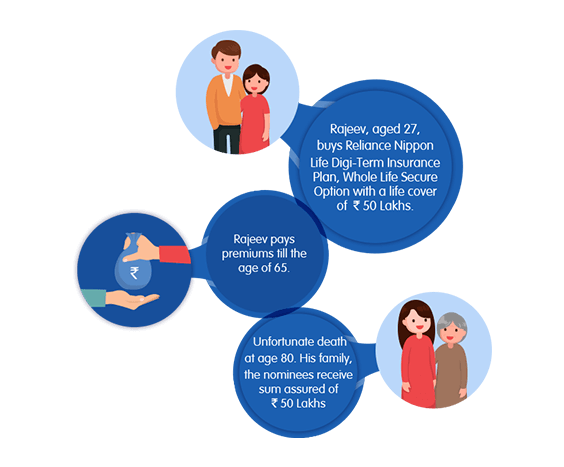

Term Plan Online Buy Digi Term Plan By Reliance Nippon Life Insurance From reliancenipponlife.com

Term Plan Online Buy Digi Term Plan By Reliance Nippon Life Insurance From reliancenipponlife.com

While there is no ideal sum assured for Health Insurance policy for an individual there are two market-broadly-accepted rules on its quantum. However the benefit amount or sum assured works differently in different policies. Enhanced Sum Assured means the amount if applicable as specified in the Schedule under the Policy. The benefit of cumulative bonus is granted in the year of renewal by making an increase in the sum insured amount only up to a certain year for every claim-free year. Cumulative Bonus is the bonus or rather a reward that a policyholder gets for remaining fit and not filing a claim. Maturity Benefit The higher of the Fund Value or.

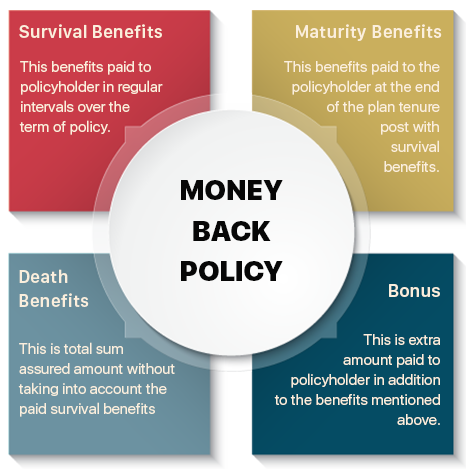

Cumulative Bonus is the bonus or rather a reward that a policyholder gets for remaining fit and not filing a claim.

What is Sum Assured. Death Benefit If the Life Insured dies within the Policy Tenure the Basic Sum Assured Fund Value Enhanced Sum Assured if any would be paid as the Death Benefit and the policy would be terminated. How does cumulative bonus work. And second the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice.

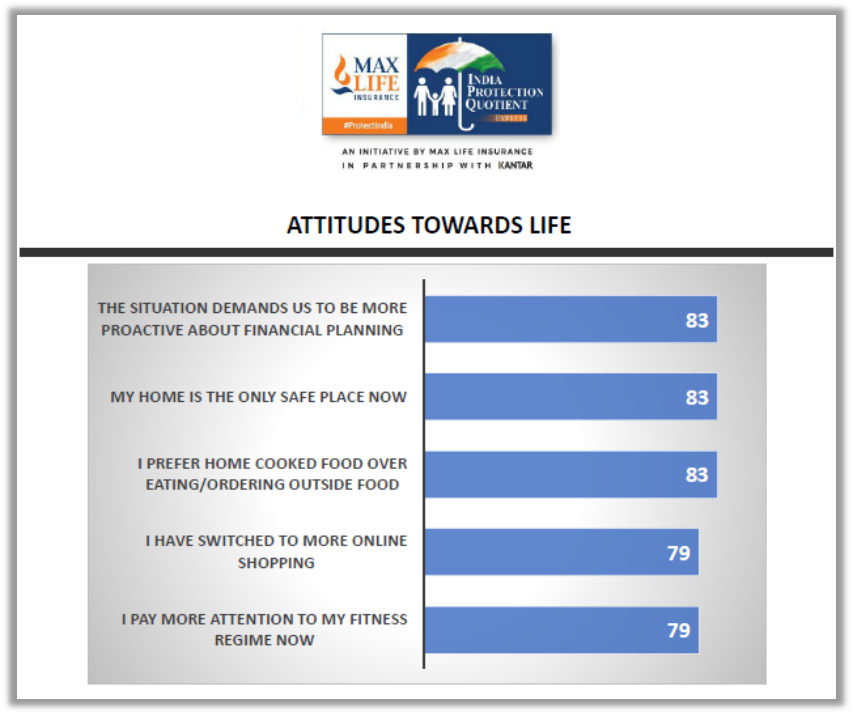

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

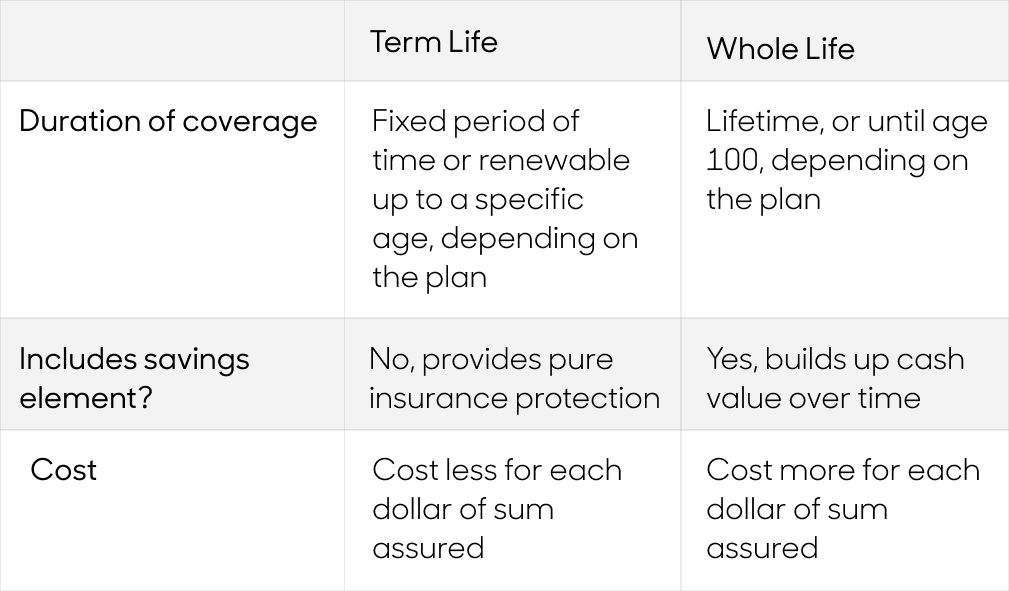

Source: paradigmlife.net

Source: paradigmlife.net

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

4 is the Enhanced Sum Assured at the time of death. While there is no ideal sum assured for Health Insurance policy for an individual there are two market-broadly-accepted rules on its quantum. It is also called the benefit amount in insurance. In other words sum assured is the guaranteed amount the. Minimum Guaranteed Sum Assured on Maturity is nil for each of the above.

Source: reliancenipponlife.com

Source: reliancenipponlife.com

4 is the Enhanced Sum Assured at the time of death. The amount that the assurer agrees to pay on the occurrence of an event. But the sum assured will be adjusted to 55000 instead. The literal meaning of the term sum assured is promised sum or the amount that has been assured to you by the insurer. Guaranteed Maturity Benefit - The minimum Guaranteed Maturity Benefit is.

Source: reliancenipponlife.com

Source: reliancenipponlife.com

Sum assured is a term inseparable from insurance more specifically the life insurance. A hospital cash policy that gives a pre-defined daily cash benefit till the time the policyholder is hospitalized and surgical benefit plans pays the sum assured against a defined surgery. It is also called the benefit amount in insurance. While there is no ideal sum assured for Health Insurance policy for an individual there are two market-broadly-accepted rules on its quantum. Enhanced Sum Assured at the time of death.

Source: paradigmlife.net

Source: paradigmlife.net

Cumulative Bonus is the bonus or rather a reward that a policyholder gets for remaining fit and not filing a claim. How does cumulative bonus work. The maximum sum assured may not be your current Death Total and Permanent Disability and Terminal Illness Benefit but is the amount you can choose to increase your cover to. Option to increase sum assured without providing evidence of good health. Cumulative Bonus is the bonus or rather a reward that a policyholder gets for remaining fit and not filing a claim.

Source: singlife.com

Source: singlife.com

Enhanced Sum Assured at the time of Death shall be the Basic Sum Assured increased by a simple rate of 5 per annum at each policy anniversary subject to maximum of 200 of Basic Sum Assured chosen at policy inception. The maximum sum assured may not be your current Death Total and Permanent Disability and Terminal Illness Benefit but is the amount you can choose to increase your cover to. Basic Sum Assured Enhanced Sum Assured Greater of fund Value. How does cumulative bonus work. The sum assured depends upon the income of the person and typically a maximum of up to 10 times the annual income is allowed as the sum assured.

The maximum age of DPS coverage will also be increased to include members aged 60 to 65. The maximum sum assured may not be your current Death Total and Permanent Disability and Terminal Illness Benefit but is the amount you can choose to increase your cover to. What is Sum Assured. In any case of any eventuality like death the sum assured is the amount that is paid to the beneficiary. 8Sum Assured means the absolute amount of benefit which is guaranteed to become payable on death of the Life Assured in accordance with terms and conditions of the Policy.

And second the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. This is because they are more likely to have accumulated sufficient CPF savings. It usually depends on the yearly income of the customer. The rate of increase of sum assured might be expressed as a percentage or an absolute amount. Guaranteed Maturity Benefit - The minimum Guaranteed Maturity Benefit is.

In other words sum assured is the guaranteed amount the. Maturity Benefit The higher of the Fund Value or. 4 is the Enhanced Sum Assured at the time of death. Enhanced Sum Assured at the time of Death shall be the Basic Sum Assured increased by a simple rate of 5 per annum at each policy anniversary subject to maximum of 200 of Basic Sum Assured chosen at policy inception. The sum assured as stated earlier increases every year.

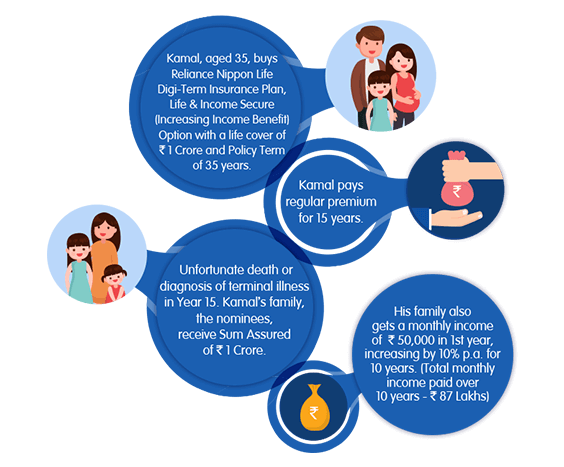

Source: reliancenipponlife.com

Source: reliancenipponlife.com

Sum assured is a term inseparable from insurance more specifically the life insurance. Sum assured is a term inseparable from insurance more specifically the life insurance. Enhanced Sum Assured at the time of death. Maturity Benefit will be as per the GMB option chosen which are mentioned below. 9Units means a specific portion or a part of the underlying segregated unit linked fund which is representative of the.

Source: maxlifeinsurance.com

Source: maxlifeinsurance.com

Option to increase sum assured without providing evidence of good health. The benefit of cumulative bonus is granted in the year of renewal by making an increase in the sum insured amount only up to a certain year for every claim-free year. The maximum age of DPS coverage will also be increased to include members aged 60 to 65. This is because they are more likely to have accumulated sufficient CPF savings. The sum assured depends upon the income of the person and typically a maximum of up to 10 times the annual income is allowed as the sum assured.

Source: reliancenipponlife.com

Source: reliancenipponlife.com

Option to increase sum assured without providing evidence of good health. Cumulative Bonus is the bonus or rather a reward that a policyholder gets for remaining fit and not filing a claim. The maximum sum assured may not be your current Death Total and Permanent Disability and Terminal Illness Benefit but is the amount you can choose to increase your cover to. The sum insured is the amount you can claim in an YEAR. The sum assured as stated earlier increases every year.

Source: reliancenipponlife.com

Source: reliancenipponlife.com

While there is no ideal sum assured for Health Insurance policy for an individual there are two market-broadly-accepted rules on its quantum. Basic Sum Assured Enhanced Sum Assured Greater of fund Value. Enhanced Sum Assured at the time of Death shall be the Basic Sum Assured increased by a simple rate of 5 per annum at each policy anniversary subject to maximum of 200 of Basic Sum Assured chosen at policy inception. It usually depends on the yearly income of the customer. It is also called the benefit amount in insurance.

While there is no ideal sum assured for Health Insurance policy for an individual there are two market-broadly-accepted rules on its quantum. The maximum sum assured may not be your current Death Total and Permanent Disability and Terminal Illness Benefit but is the amount you can choose to increase your cover to. Enhanced Sum Assured at the time of death shall be the Basic Sum Assured Increased by a simple rate of 5 per annum at each policy anniversary up to the time of death subject to maximum of 200 of Basic Sum Assured chosen at. First your health cover should be at least 50 of your annual income. Enhanced Sum Assured at the time of Death shall be the Basic Sum Assured increased by a simple rate of 5 per annum at each policy anniversary subject to maximum of 200 of Basic Sum Assured chosen at policy inception.

Source: paradigmlife.net

Source: paradigmlife.net

The sum assured as stated earlier increases every year. First your health cover should be at least 50 of your annual income. This the maximum amount to which an insurance company pays in case of claim. But the sum assured will be adjusted to 55000 instead. Death Benefit If the Life Insured dies within the Policy Tenure the Basic Sum Assured Fund Value Enhanced Sum Assured if any would be paid as the Death Benefit and the policy would be terminated.

Source: policybazaar.com

Source: policybazaar.com

The benefit of cumulative bonus is granted in the year of renewal by making an increase in the sum insured amount only up to a certain year for every claim-free year. Extra Premium means additional premium charged with the Policyholders consent for acceptance of proposal for insurance on the basis of underwriting done by the Company based on its prevailing Board approved underwriting norms. Some plans have a limit to the maximum increment in the sum assured and the increment stops after the maximum limit is reached even though the plan tenure continues. It usually depends on the yearly income of the customer. Enhanced Sum Assured means the amount if applicable as specified in the Schedule under the Policy.