This type of policy will provide a stated benefit upon your death provided that the death occurs within a specific time period. Decreasing life insurance is usually taken out alongside a mortgage.

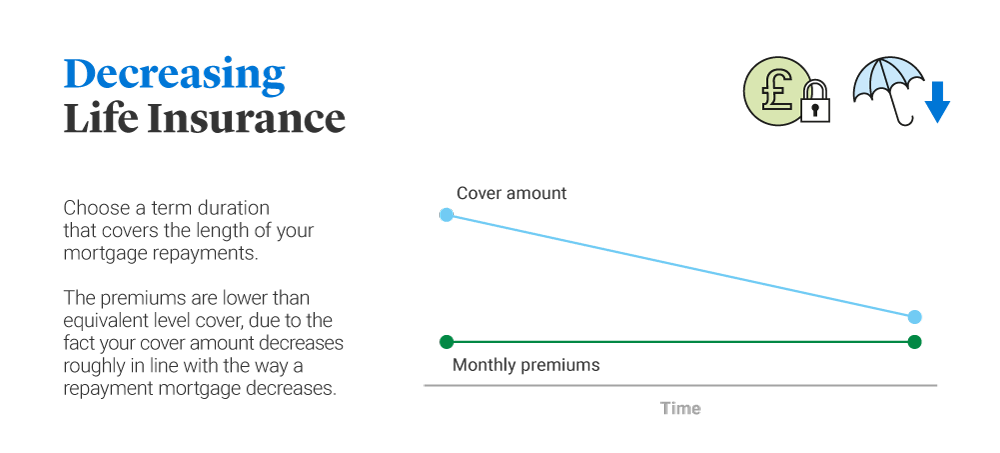

Decreasing Term Assurance Quote. Although payments stay the same over the term of the policy how much you pay each month is typically less than for level term life insurance. It will be down to zero by the end of the term. Our life cover pays out a cash lump sum if you pass away during the policy term over this period you pay monthly premiums to LV. Once the policy is active premiums are paid each month.

Mortgage Protection Insurance Vitality From vitality.co.uk

Mortgage Protection Insurance Vitality From vitality.co.uk

It will be down to zero by the end of the term. Of course death is certain at some stage. This type of policy will provide a stated benefit upon your death provided that the death occurs within a specific time period. Although payments stay the same over the term of the policy how much you pay each month is typically less than for level term life insurance. Level term assurance means that the amount that your dependents receive in the event of your death during this period is fixed ie. As described above a decreasing term policy has a changing sum assured that lowers over the term.

An insurance policy that decreases over a fixed period of time.

The sum assured pay out amount and term length is specified during the application. As time goes on the pay-out decreases premiums remain the same. Decreasing life insurance is usually taken out alongside a mortgage. A decreasing term assurance policy is usually the same as a mortgage term assurance policy.

Source: vitality.co.uk

Source: vitality.co.uk

Source: fi.pinterest.com

Source: fi.pinterest.com

Source: budgetinsurance.com

Source: budgetinsurance.com

Source: comparethemarket.com

Source: comparethemarket.com

So for a fixed lump sum payable upon death during a pre-determined period level term life insurance is worthwhile considering. Decreasing-term life insurance is often much cheaper than level-term. Decreasing life insurance is usually taken out alongside a mortgage. The sum assured pay out amount and term length is specified during the application. So Assurance is used.

Source: qq-life.co.uk

Source: qq-life.co.uk

Term is the number of years the policy will be live. Fixed term of years selected to match your mortgage. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. You can also take out Critical Illness cover with your Life Insurance where a cash lump sum is paid to you if youre die or are diagnosed with one of the listed critical illnesses during the term of the policy. How often your benefit decreases and the amount it decreases is set when you buy your policy.

Source: fairerfinance.com

Source: fairerfinance.com

For example say you purchased a 25-year decreasing term life insurance policy with a face value of 500000. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. Assurance is a type of insurance. Die at any point in the 25 years and the beneficiary receives enough to.

Source: budgetinsurance.com

Source: budgetinsurance.com

Decreasing Term Assurance DTA insures you for a decreasing amount for a set length of time. It will be down to zero by the end of the term. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis. Assurance another word for insurance. So for a fixed lump sum payable upon death during a pre-determined period level term life insurance is worthwhile considering.

Source: legalandgeneral.com

Source: legalandgeneral.com

Sum assured decreased to reflect the outstanding loan amount each year. Decreasing simply means the amount of life insurance that gets paid out if you die decreases throughout the life of the policy. Die at any point in the 25 years and the beneficiary receives enough to. An insurance policy that decreases over a fixed period of time. Some good reasons to get a decreasing term policy include.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. So Assurance is used. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. So for a fixed lump sum payable upon death during a pre-determined period level term life insurance is worthwhile considering. This is because the payout reduces each month similar to your mortgage balance after repayments.

Source: legalandgeneral.com

Source: legalandgeneral.com

The sum assured pay out amount and term length is specified during the application. Its used when the event that is being insured against is certain. You pay for the cost of the insurance either annually or in monthly instalments. Life insurance cover for a specified period is referred to as term assurance. Assurance another word for insurance.

Source: pinterest.com

Source: pinterest.com

Decreasing Term Assurance DTA insures you for a decreasing amount for a set length of time. Many life insurances are level. Youll take out a decreasing life policy for a fixed period of time called the term. But there are other options DTA being one of them. This cover also known as level term assurance or decreasing term assurance will pay off the loan in the event of your untimely death.

Source:

Source:

If you died during the first year of coverage your beneficiaries would receive the full 500000 death benefit. Decreasing Term Life Insurance is one of the most common types of life insurance policy you can buy. Fixed term of years selected to match your mortgage. Throughout the policy term the value of. Level term assurance means that the amount that your dependents receive in the event of your death during this period is fixed ie.

Source: budgetinsurance.com

Source: budgetinsurance.com

If you died during the first year of coverage your beneficiaries would receive the full 500000 death benefit. It protects a repayment mortgage by mirroring the outstanding balance which reduces over time. Sum assured is paid out on death during the policy term. It is designed to pay out a tax free cash lump sum on death to ensure your loved ones are financially secure should the worst happen. If the policys coverage was set to reduce by 4 per year then the death benefit would be 480000 during year two a total reduction of 20000.

Source: quotesgram.com

Source: quotesgram.com

Decreasing Term Assurance. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. Decreasing simply means the amount of life insurance that gets paid out if you die decreases throughout the life of the policy. Our life cover pays out a cash lump sum if you pass away during the policy term over this period you pay monthly premiums to LV. The death benefit is what decreases over time and are an affordable and smart choice to cover a.

Source: fi.pinterest.com

Source: fi.pinterest.com

Decreasing Term Assurance. This cover also known as level term assurance or decreasing term assurance will pay off the loan in the event of your untimely death. How often your benefit decreases and the amount it decreases is set when you buy your policy. Level term assurance means that the amount that your dependents receive in the event of your death during this period is fixed ie. As described above a decreasing term policy has a changing sum assured that lowers over the term.

Source: vitality.co.uk

Source: vitality.co.uk

If you died during the first year of coverage your beneficiaries would receive the full 500000 death benefit. Decreasing simply means the amount of life insurance that gets paid out if you die decreases throughout the life of the policy. Sum assured is paid out on death during the policy term. It is designed to pay out a tax free cash lump sum on death to ensure your loved ones are financially secure should the worst happen. The amount the policy pays out falls as the insurance term progresses on a monthly or yearly basis.

Source: secure.fundsupermart.com

Source: secure.fundsupermart.com

Decreasing Term Assurance Product Features. In the event that the policyholder dies the insurance payout would be sufficient to clear the outstanding mortgage balance. This is whats known as your premium. Many life insurances are level. As time goes on the pay-out decreases premiums remain the same.

Source: reassured.co.uk

Source: reassured.co.uk

Assurance is a type of insurance. You pay the same amount each month or year but your death benefit grows smaller. Decreasing life insurance is usually taken out alongside a mortgage. Decreasing Term Life Insurance QuickQuote Decreasing Term Life Insurance Decreasing term life insurance provides financial security for a pre-determined set period of time. Assurance is a type of insurance.