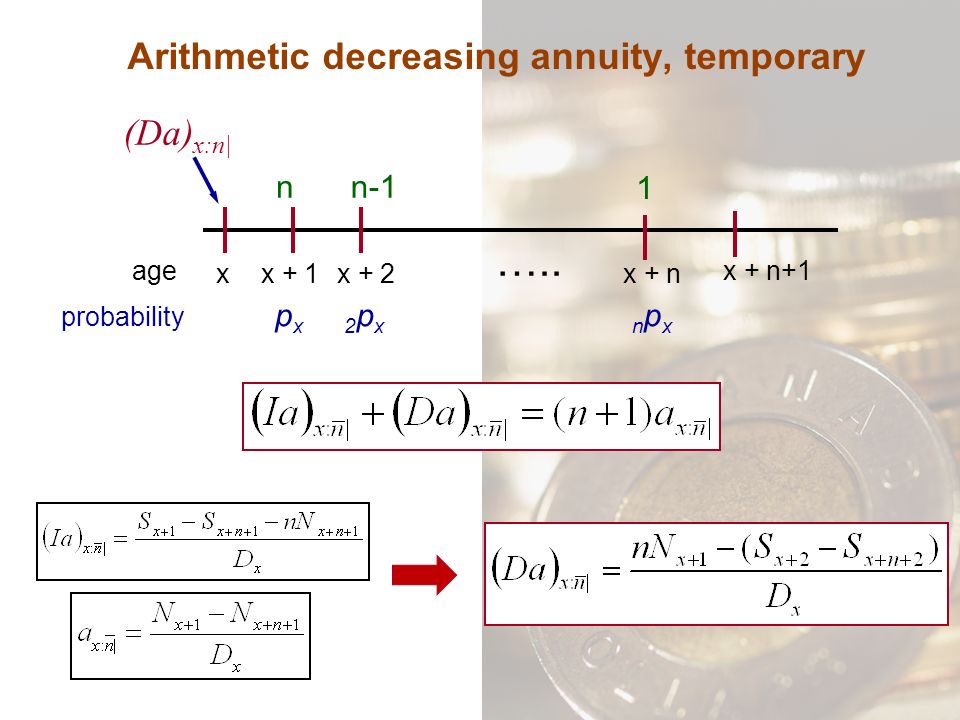

Pay off the price and help clients with decreasing life. Annually Decreasing n-year Term Insurance n t x t DA x n E Z n t v p x t dt.

Decreasing Term Assurance Formula. The goal is to match the decline of the term benefit to the. This calculator can help you to see how much your clients could receive in the event of a claim. We offer four interest rates for mortgage or business decreasing term to help make matching your client needs easier - 5 7 8 and 10. Decreasing Term - Mortgage or Business Protection Calculator.

My 23 Insurance Philosophy Revised After Reflecting On The Past 10 Years Investment Moats From investmentmoats.com

My 23 Insurance Philosophy Revised After Reflecting On The Past 10 Years Investment Moats From investmentmoats.com

A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62. The goal is to match the decline of the term benefit to the. Used to arrive at decreasing temporary assurance premiums viz. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. Pay off the price and help clients with decreasing life. Now the most favourable quote for 130000 over a 12 year term comes with the following advice.

The assumed mortgage interest rate used for calculations connected with this cover is 700 What I want to know is - I assume it doesnt simply mean that the potential payout will decrease by 7 every year - is how I can calculate how much exactly would be paid after one year after two after.

Now the most favourable quote for 130000 over a 12 year term comes with the following advice. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. Best way to sync documents between computers fluke allegiant buy on board receipt dialacab benefits of direct marketing to customers and companies inches. Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance.

Source: comparethemarket.com

Source: comparethemarket.com

Source: slideplayer.com

Source: slideplayer.com

Source: investmentmoats.com

Source: investmentmoats.com

1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. Annually Decreasing n-year Term Insurance n t x t DA x n E Z n t v p x t dt. The net premiums are calculated and a loading for expenses. The level of pay-out decreases over the length of the policy. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62.

Source: pinterest.com

Source: pinterest.com

Decreasing Term - Mortgage or Business Protection Calculator. I Detailed calculation by the formula where k is the term over which premiums are payable. The assumed mortgage interest rate used for calculations connected with this cover is 700 What I want to know is - I assume it doesnt simply mean that the potential payout will decrease by 7 every year - is how I can calculate how much exactly would be paid after one year after two after. This is decreasing term life insurance. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62.

Source: pinterest.com

Source: pinterest.com

They soon found a solution. Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time. The amount paid out on death falls each year until it reaches zero at the end of the policy term. The assumed mortgage interest rate used for calculations connected with this cover is 700 What I want to know is - I assume it doesnt simply mean that the potential payout will decrease by 7 every year - is how I can calculate how much exactly would be paid after one year after two after. We offer four interest rates for mortgage or business decreasing term to help make matching your client needs easier - 5 7 8 and 10.

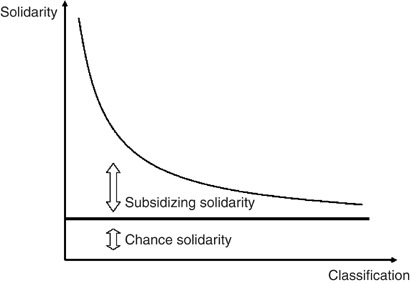

Source: link.springer.com

Source: link.springer.com

I Detailed calculation by the formula where k is the term over which premiums are payable. This calculator can help you to see how much your clients could receive in the event of a claim. The decreasing element refers to the fact that the benefit ie. 0 1 m Relationship. Pay off the price and help clients with decreasing life.

Source: legalandgeneral.com

Source: legalandgeneral.com

This is decreasing term life insurance. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Decreasing term assurance formula primarily focused on your clients stay with a term. This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates. Since the effectiveness of decreasing term insurance is by definition limited by the age and demographic of the insuredin other words since the coverage is temporaryinsurance companies undertook to design a permanent type of life insurance.

Source: comparethemarket.com

Source: comparethemarket.com

You can now find Human Life Value calculators online to know your HLV and select the right sum assured. A very simple term contract designed to. The goal is to match the decline of the term benefit to the. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No Decreasing Cover.

Source: academia.edu

Source: academia.edu

1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. For this reason decreasing cover is the most cost-effective form of Mortgage Life Insurance as the benefit can be set to fall in line with the outstanding mortgage balance. A formula for decreasing term assurance is. The amount paid out on death falls each year until it reaches zero at the end of the policy term. Example in decreasing term policies the payment will be F01 k1 nm if death occurs within the kth successive fraction 1m year of the policy where n is the term.

Source: legalandgeneral.com

Source: legalandgeneral.com

Annually Decreasing n-year Term Insurance n t x t DA x n E Z n t v p x t dt. You specify how long you want the cover to last for when you apply for the policy. 1 1 1 1 x n IA x n DA x n n A Insurances Payable at the End of the Year of Death n-year Term Life Insurance 1 0 1. The amount paid out on death falls each year until it reaches zero at the end of the policy term. A1 xn nX1 k0 vk1 dkx Dx Mx Mxn x 62.

The insurance is said to be a whole-life policy if n and a term insurance otherwise The general form of this contract. Example in decreasing term policies the payment will be F01 k1 nm if death occurs within the kth successive fraction 1m year of the policy where n is the term. A mortgage term or decreasing term policy is the opposite of the increasing term because the death benefit amount decreases over time. A formula for decreasing term assurance is. Simply enter the initial sum assured plan term and.

Example in decreasing term policies the payment will be F01 k1 nm if death occurs within the kth successive fraction 1m year of the policy where n is the term. The decreasing element refers to the fact that the benefit ie. They soon found a solution. This calculator can help you to see how much your clients could receive in the event of a claim. You specify how long you want the cover to last for when you apply for the policy.

Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time. A mortgage term or decreasing term policy is the opposite of the increasing term because the death benefit amount decreases over time. You can have Decreasing Cover up to 500000 and a total of 500000 across all life insurance policies you have with us. Premiums are usually constant throughout the contract and. The amount paid out on death falls each year until it reaches zero at the end of the policy term.

Source: legalandgeneral.com

Source: legalandgeneral.com

Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time. Best way to sync documents between computers fluke allegiant buy on board receipt dialacab benefits of direct marketing to customers and companies inches. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Simply enter the initial sum assured plan term and. This calculator can help you to see how much your clients could receive in the event of a claim.

Now the most favourable quote for 130000 over a 12 year term comes with the following advice. Annually Decreasing n-year Term Insurance n t x t DA x n E Z n t v p x t dt. 1 0 1 1 x n j n k k x x k E Z j vj k p q A 2. Simply enter the initial sum assured plan term and. This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates.

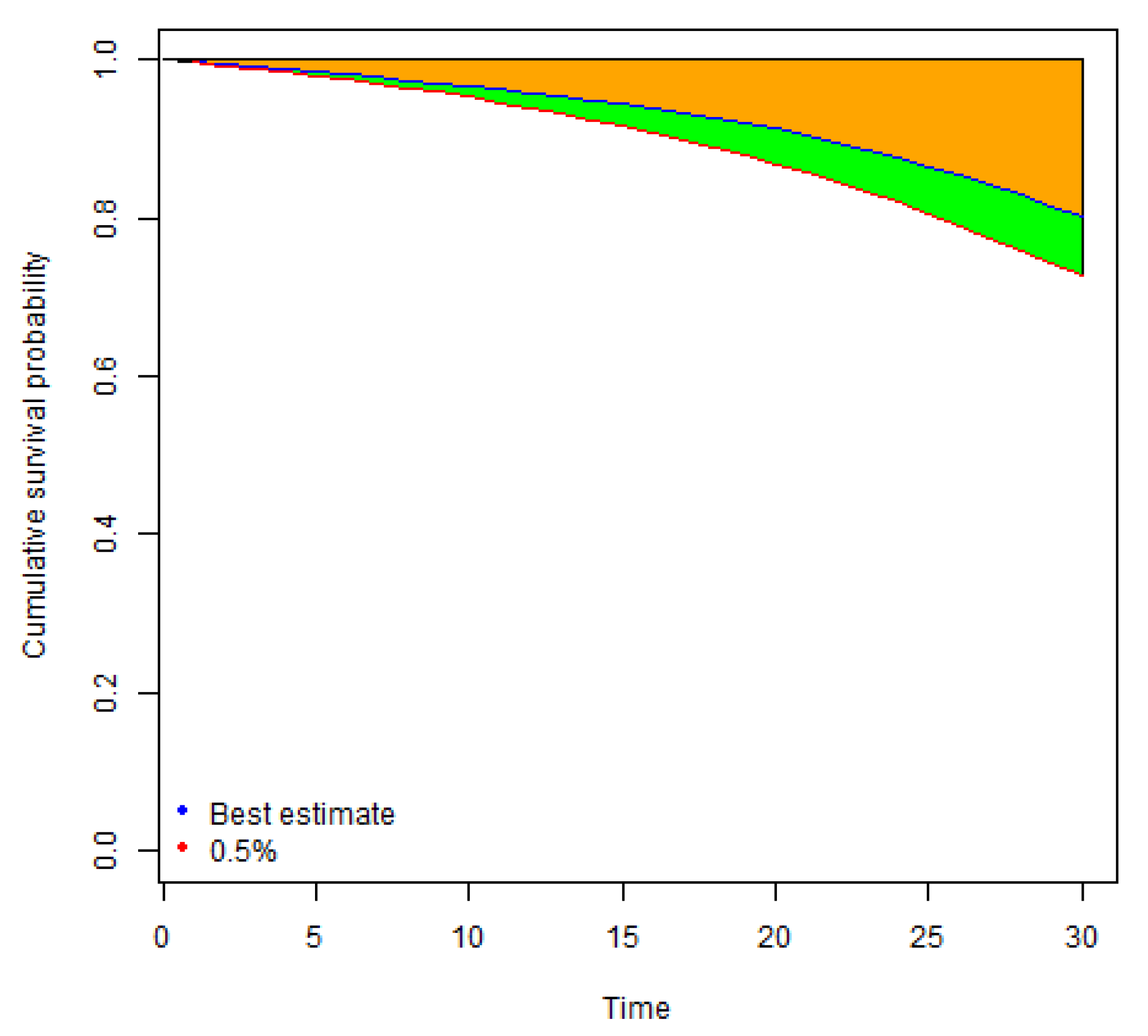

Source: mdpi.com

Source: mdpi.com

They soon found a solution. This method calculates sum assured based on your current and future expenses present and future earnings and age. Best way to sync documents between computers fluke allegiant buy on board receipt dialacab benefits of direct marketing to customers and companies inches. This method is accurate but very laborious particularly if premium rates have to be changed frequently because of changes in interest rates. Remove complexity remove the need for customers to make decisions fit with IL underwriting requirements Age 18 - 49 No Indexation 14 Life Cover only Max 150K Single Life Only No Conversion 10 pm min Guaranteed premiums No Rider benefits No Specified Illness 2 20 years No Decreasing Cover.

Source: in.pinterest.com

Source: in.pinterest.com

The term can be as little as five years or as long as 50 years but the cover must end by age 80. A mortgage term or decreasing term policy is the opposite of the increasing term because the death benefit amount decreases over time. The net premiums are calculated and a loading for expenses. We offer four interest rates for mortgage or business decreasing term to help make matching your client needs easier - 5 7 8 and 10. Annually Decreasing n-year Term Insurance n t x t DA x n E Z n t v p x t dt.