A life insurance agreement in which the amount paid over a fixed period of time is low and remains. The premiums do not however reduce.

Decreasing Term Assurance Definition. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Decreasing Term Assurance to cover a loan is a form of Mortgage Protection. Maurice HowseS COLUMN family finance It is one of the most inexpensive ways to protect a loan the only cheaper way would have been to have a decreasing term assurance policy where the sum goes down every year as you make payments to the bank or building society you. Sum assured decreased to reflect the outstanding loan amount each year.

Pin On The World Of Insurance From pinterest.com

Pin On The World Of Insurance From pinterest.com

Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. Decreasing refers to the pay-out reducing over time. Deˌcreasing ˈterm asˌsurance an insurance agreement over a fixed period of time in which the sum insured gets smaller each year This type of mortgage is usually arranged in conjunction with decreasing term assurance. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit. Your life insurance premiums. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label.

Term life insurance plans keep you covered financially for a set period of time.

For example one may purchase a decreasing term life insurance policy for a. Decreasing term insurance is a life insurance product that provides decreasing coverage over the term of the policy. With a decreasing term life insurance policy the death benefit for the plan decreases over time. An insurance policy that decreases.

Source: businesstoday.in

Source: businesstoday.in

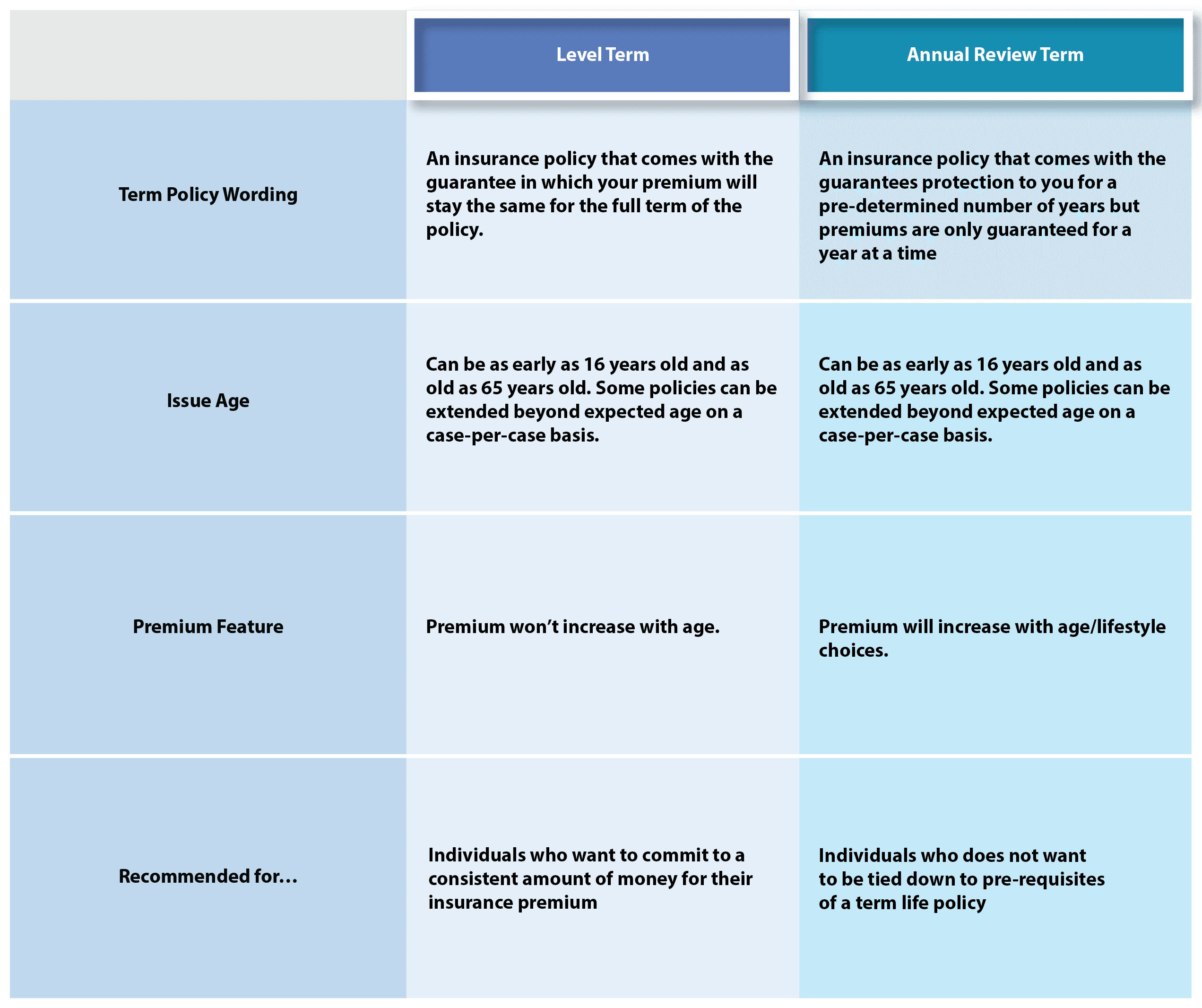

Source: lsminsurance.ca

Source: lsminsurance.ca

Source: ringgitplus.com

Source: ringgitplus.com

Source: es.pinterest.com

Source: es.pinterest.com

A decreasing term life insurance policy is typically cheaper than a level term policy because the death benefit your beneficiaries would receive is reduced over time. Decreasing term life insurance is similar to level term with one significant difference the amount of insurance reduces over time roughly in line with the way a repayment mortgage decreases. Decreasing refers to the pay-out reducing over time. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term.

Source: pinterest.com

Source: pinterest.com

Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract. For example one may purchase a decreasing term life insurance policy for a. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. You pay the same amount each month or year but your death benefit grows smaller.

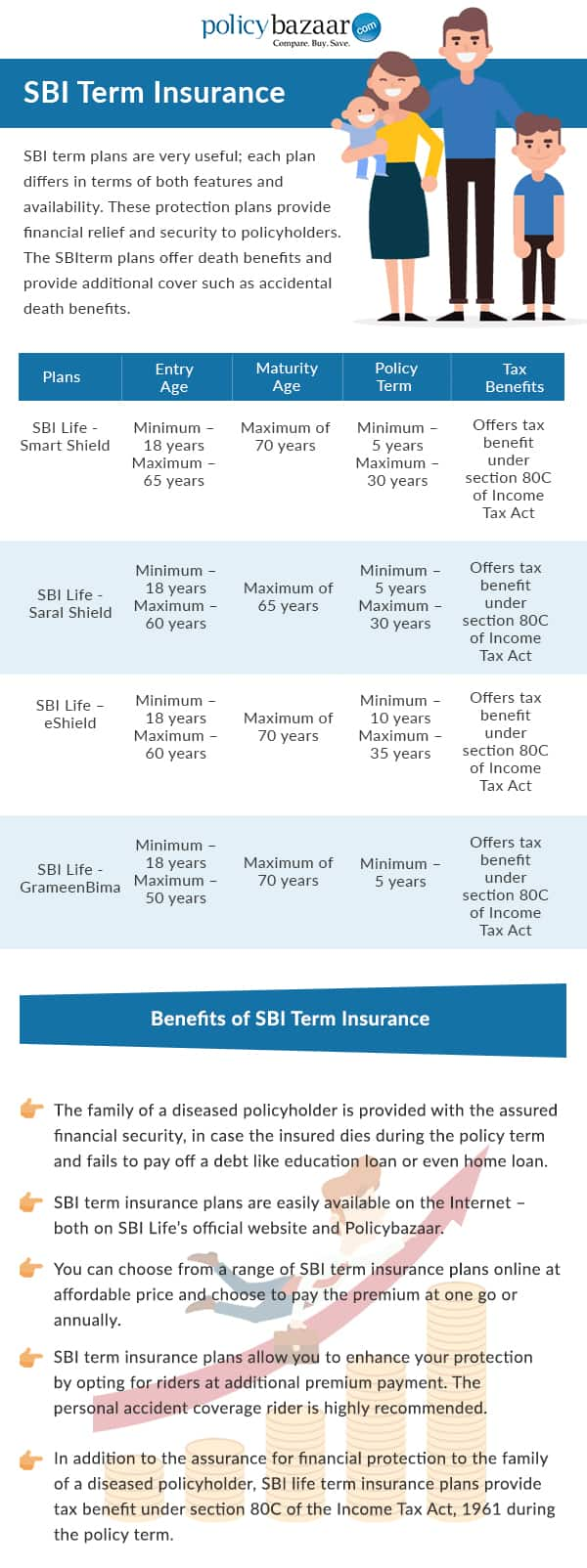

Source: policybazaar.com

Source: policybazaar.com

Decreasing term insurance also called DTA insurance can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. A life insurance agreement in which the amount paid over a fixed period of time is low and remains. With a decreasing term life insurance policy the death benefit for the plan decreases over time. Similar to level term assurance but the amount of cover decreases over the period of the policy. Term means it has a fixed number of years to run and eventually expires.

Source: businesstoday.in

Source: businesstoday.in

Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term. Decreasing Term Assurance to cover a loan is a form of Mortgage Protection. Due to the nature of decreasing term insurance the policy is generally cheaper than level term insurance. A decreasing term life insurance policy is the most common and cost-effective way of covering a repayment mortgage as the amount of cover can reduce over time in line with your mortgage balance. Its usually purchased to help clear a specific debt such as a repayment mortgage.

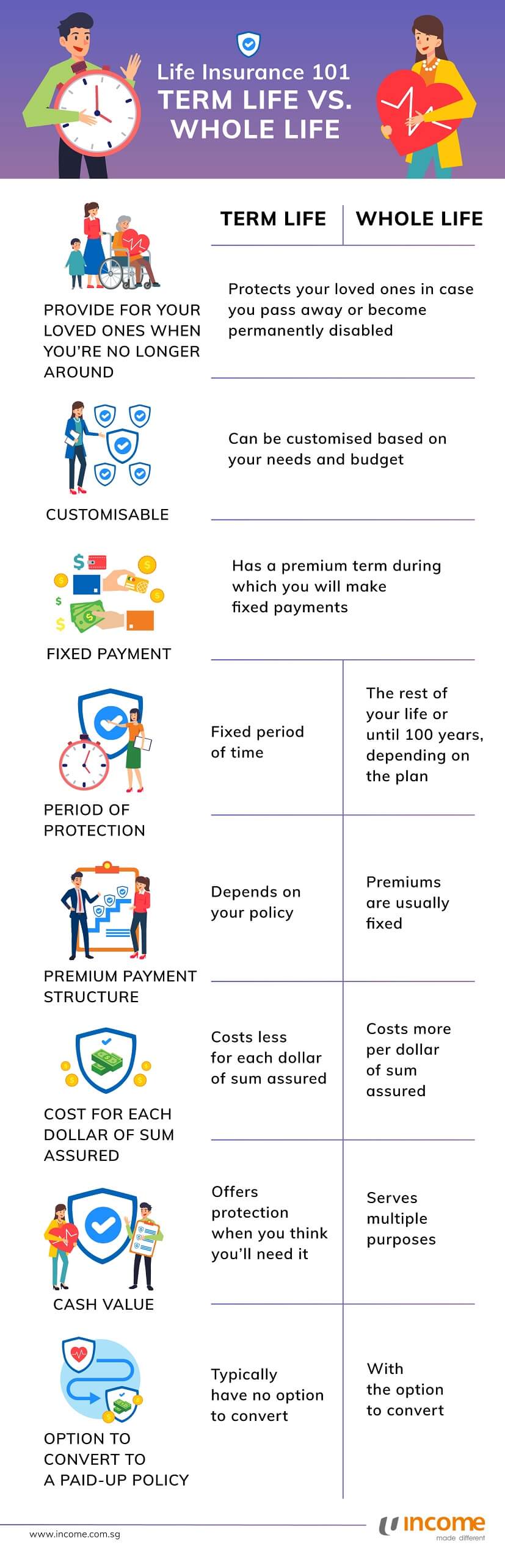

Source: income.com.sg

Source: income.com.sg

The premiums do not however reduce. With a decreasing term life insurance policy the death benefit for the plan decreases over time. These plans are generally more affordable than other types of term life insurance making them a smart choice if you just need insurance to cover a temporary need or plan to leave little to no debt for your family to. The level of benefit decreases as the term of the policy runs. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label.

Source: policybazaar.ae

Source: policybazaar.ae

Deˌcreasing ˈterm asˌsurance an insurance agreement over a fixed period of time in which the sum insured gets smaller each year This type of mortgage is usually arranged in conjunction with decreasing term assurance. The exact amount of. With a decreasing term life insurance policy the death benefit for the plan decreases over time. Maurice HowseS COLUMN family finance It is one of the most inexpensive ways to protect a loan the only cheaper way would have been to have a decreasing term assurance policy where the sum goes down every year as you make payments to the bank or building society you. Decreasing Term Insurance A term life insurance policy in which the policyholder pays a constant premium but the benefit decreases over time either on a monthly quarterly or yearly basis.

Source: ringgitplus.com

Source: ringgitplus.com

Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. How often your benefit decreases and the amount it decreases is set when you buy your policy. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. The death benefit will decrease on a monthly or annual basis.

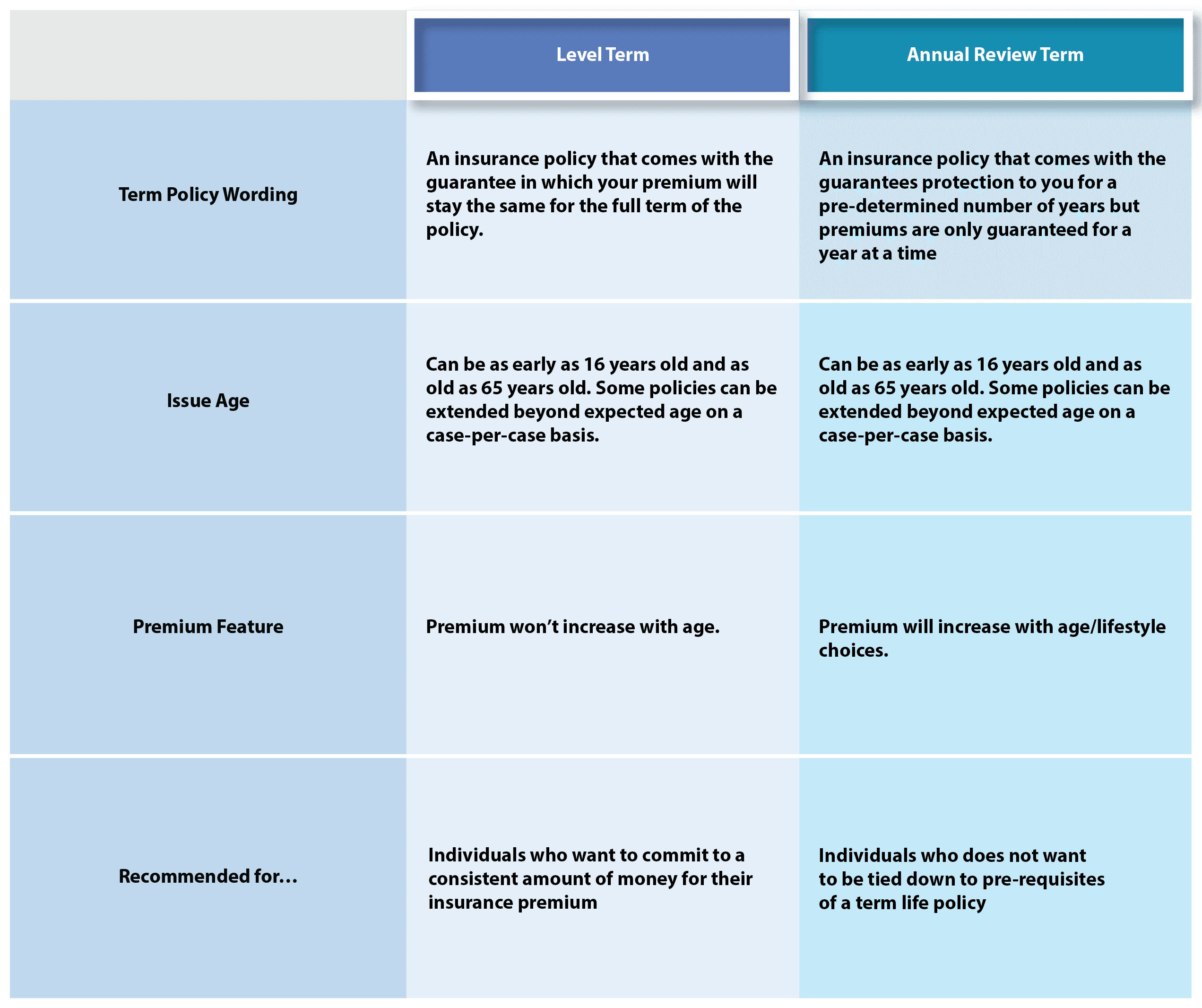

Source: lsminsurance.ca

Source: lsminsurance.ca

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Due to the nature of decreasing term insurance the policy is generally cheaper than level term insurance. Term life insurance plans keep you covered financially for a set period of time. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit.

Source: in.pinterest.com

Source: in.pinterest.com

Premiums are usually constant throughout the contract and. Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. Decreasing term life insurance is similar to level term with one significant difference the amount of insurance reduces over time roughly in line with the way a repayment mortgage decreases. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit.

Source: pinterest.com

Source: pinterest.com

Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. Premiums are usually constant throughout the contract and. Term life insurance plans keep you covered financially for a set period of time. Decreasing term life insurance is defined as a term life policy that provides the beneficiary a gradually decreasing death benefit over the life of the policy. Decreasing term assurance uncountable Term assurance with a sum assured that decreases over the term of the contract.

Source: policybazaar.com

Source: policybazaar.com

Combining these three terms decreasing term life insurance or decreasing term life assurance DTA is a policy of financial cover that will pay a lump sum to your beneficiaries if you die within the period agreed the term. The level of benefit decreases as the term of the policy runs. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Term means it has a fixed number of years to run and eventually expires. Decreasing refers to the pay-out reducing over time.

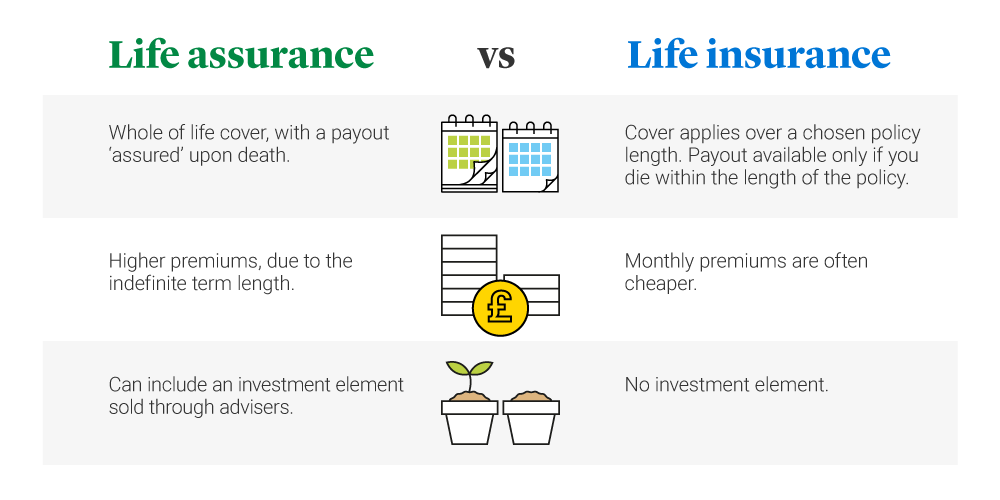

Source: comparethemarket.com

Source: comparethemarket.com

Assurance shows that it is an insurance product. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Your life insurance premiums. Decreasing term assurance definition. Sum assured is paid out on death during the policy term.

A decreasing term life insurance policy is the most common and cost-effective way of covering a repayment mortgage as the amount of cover can reduce over time in line with your mortgage balance. Due to the nature of decreasing term insurance the policy is generally cheaper than level term insurance. The level of benefit decreases as the term of the policy runs. Deˌcreasing ˈterm asˌsurance an insurance agreement over a fixed period of time in which the sum insured gets smaller each year This type of mortgage is usually arranged in conjunction with decreasing term assurance. The premiums are fixed throughout the policy term and the premium level is lower than that of Level Term Assurance as a result of the decreasing benefit.

Source: pinterest.com

Source: pinterest.com

Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy matures. No benefit on survival. Its usually purchased to help clear a specific debt such as a repayment mortgage. Decreasing Term Assurance to cover a loan is a form of Mortgage Protection. Premiums normally remain the same throughout the life of the policy which can range from one to 30 years.

Source: legalandgeneral.com

Source: legalandgeneral.com

Decreasing Term Insurance A term life insurance policy in which the policyholder pays a constant premium but the benefit decreases over time either on a monthly quarterly or yearly basis. Sum assured decreased to reflect the outstanding loan amount each year. Sum assured is paid out on death during the policy term. The least expensive of the Term Assurances Decreasing Term Assurance does what it says on the label. Similar to level term assurance but the amount of cover decreases over the period of the policy.