Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. In small premiums higher critical illness is covered thereby insuring higher coverage and benefit.

Critical Illness With Term Assurance. AIG Business Protection Critical Illness with Term Assurance can be taken out to protect your business from the death terminal illness or critical illness of a key person for shareholder or partnership protection or for business loan protection. Call 0800 622 323 today. The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. If you make a successful critical illness.

Gladstone Morgan Company Limited Critical Illness And Life Assurance Planning Gla Critical Illness Gladstone Life From in.pinterest.com

Gladstone Morgan Company Limited Critical Illness And Life Assurance Planning Gla Critical Illness Gladstone Life From in.pinterest.com

Is diagnosed with one of the critical illnesses specified in your policy document or dies. Premiums can be guaranteed throughout the term or reviewable at certain intervals but should you survive the policy term there will be no benefit. Critical Illness with Term Assurance beneft When we will pay the beneft depends on the cover shown in the Cover Summary. Decreasing refers to the pay-out reducing over time. AIG Business Protection Critical Illness with Term Assurance can be taken out to protect your business from the death terminal illness or critical illness of a key person for shareholder or partnership protection or for business loan protection. Decreasing Term Assurance And Critical Illness Cover.

Decreasing refers to the pay-out reducing over time.

In this case the protection is for your family or other financial dependents as it will provide them with a payment in the event of your death. The primary objective to include a critical illness rider in a term plan is to get financial protection for the expensive treatments. Or born child of the person covered is diagnosed with a childrens critical illness and they survive for 10 days. 8 rows Term Insurance with Critical Illness Rider.

Source: in.pinterest.com

Source: in.pinterest.com

Source: id.pinterest.com

Source: id.pinterest.com

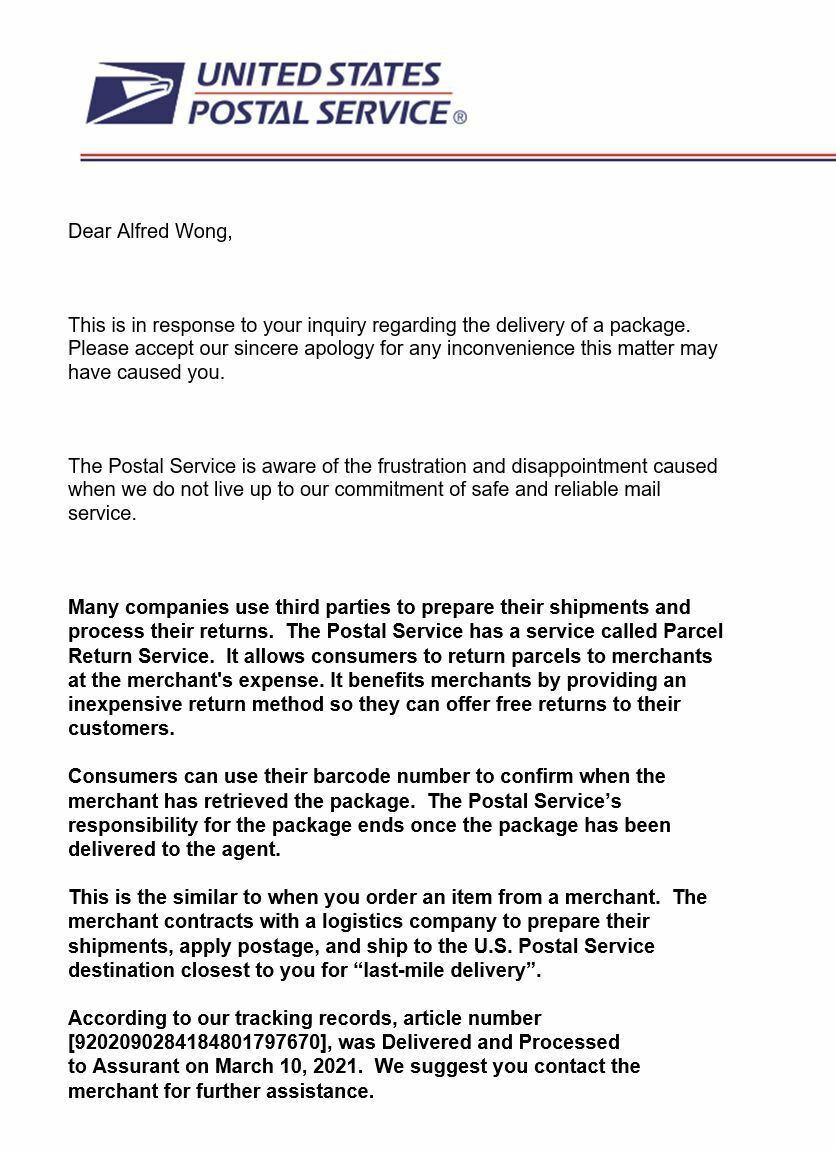

Source: ringgitplus.com

Source: ringgitplus.com

Source: pinterest.com

Source: pinterest.com

If you make a successful critical illness. The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. In small premiums higher critical illness is covered thereby insuring higher coverage and benefit. For a 30-year old non-smoking male with sum assured of S100000 and policy term of 45 years For a 35-year old non-smoking male with sum assured of S100000 and policy term of 30 years.

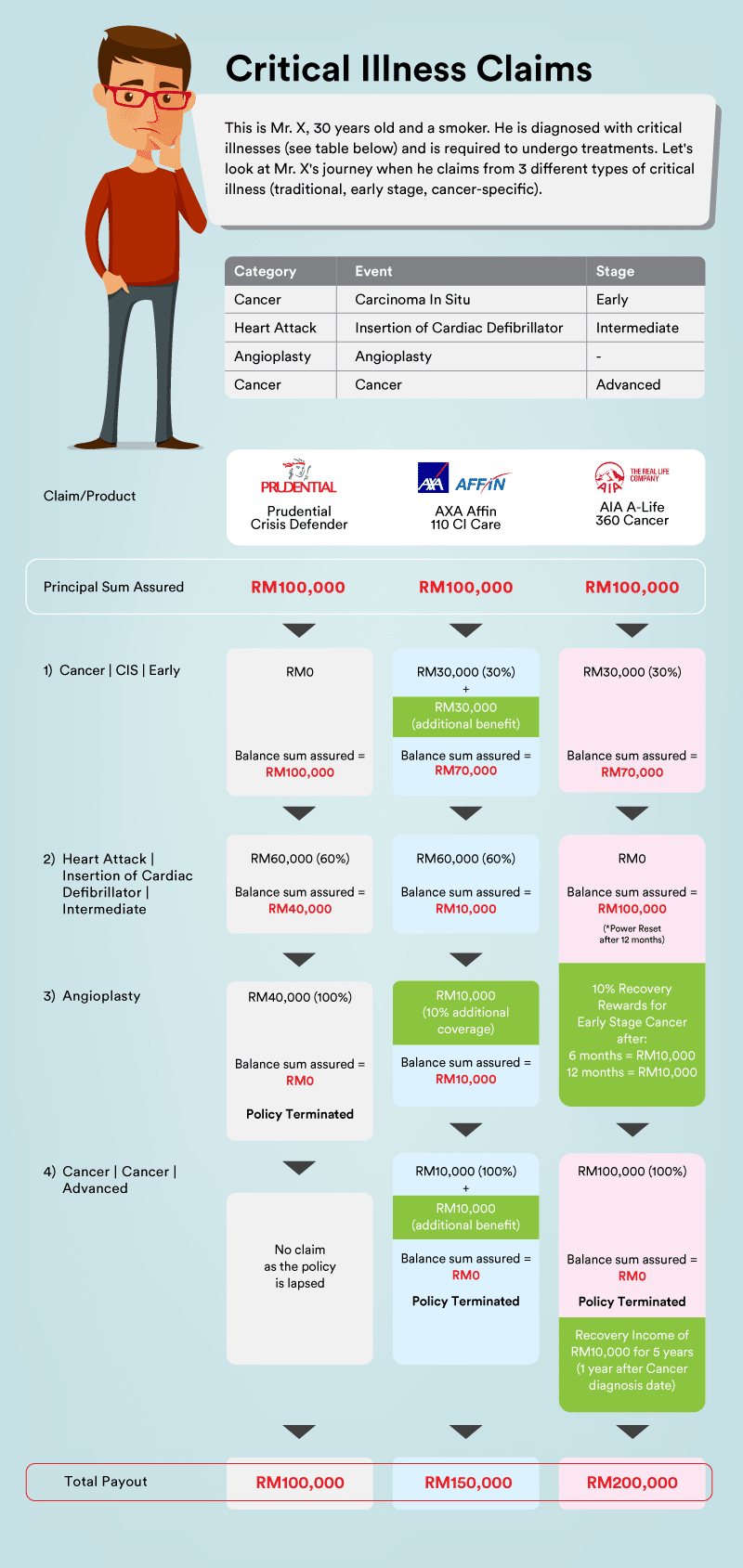

Source: aia.com.sg

Source: aia.com.sg

If the sum paid out under AIG Business Protection Critical Illness with Term Assurance forms part. Here are five more critical illness plans for you to consider in case you need to cast a wider net in terms of conditions or stages covered. A term assurance policy is a type of protection insurance. Critical Illness Benefit means the Sum Assured as shown in the Policy Schedule which becomes payable if a Life Assured is diagnosed with an illness or suffers from an accident which results in them meeting all of the claim requirements of one or more of the defined Critical Illness events and definitions. AIG Term Assurance with Critical Illness Choices will take care of your loved ones should you face a terminal diagnosis.

Source: ar.pinterest.com

Source: ar.pinterest.com

Any of the persons covered die or are diagnosed with a terminal illness or a critical illness. This is known as the term. AIG Term Assurance with Critical Illness Choices will take care of your loved ones should you face a terminal diagnosis. Or born child of the person covered is diagnosed with a childrens critical illness and they survive for 10 days. Assured dies or is diagnosed with a terminal or critical illness.

Source: policybazaar.com

Source: policybazaar.com

The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. The term insurance plan is the most basic as well. A term assurance policy is a type of protection insurance. The insured can save on taxes under section 80 C and 80D of income tax act. If the life assured has a critical illness it must be verified by a medical specialist who holds an appointment as a consultant at a hospital in the UK and whose specialism we reasonably consider is appropriate to the critical illness.

Source: pinterest.com

Source: pinterest.com

The primary objective to include a critical illness rider in a term plan is to get financial protection for the expensive treatments. If you make a successful critical illness. The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. What is Level Term Assurance with Critical Illness Cover. At the end of the term if you have not become critically ill no payment will be made.

Source: pinterest.com

Source: pinterest.com

Sum that can be used to pay off the remaining balance of your mortgageloan in the event of death andor diagnosis of a critical illness. The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. Click to open Critical illness cover. If the life assured has a critical illness it must be verified by a medical specialist who holds an appointment as a consultant at a hospital in the UK and whose specialism we reasonably consider is appropriate to the critical illness. Call 0800 622 323 today.

Source: pinterest.com

Source: pinterest.com

Or born child of the person covered is diagnosed with a childrens critical illness and they survive for 10 days. Is diagnosed with one of the critical illnesses specified in your policy document or dies. For a 30-year old non-smoking male with sum assured of S100000 and policy term of 45 years For a 35-year old non-smoking male with sum assured of S100000 and policy term of 30 years. The insured can save on taxes under section 80 C and 80D of income tax act. AIG Term Assurance with Critical Illness Choices will take care of your loved ones should you face a terminal diagnosis.

Source: in.pinterest.com

Source: in.pinterest.com

This is known as the term. AIG Critical Illness with Term Assurance is designed to pay out a lump sum when the person covered dies or is diagnosed with a terminal illness - where life expectancy is less than 12 months or suffers or undergoes one of the specified critical illnesses or operations during the term of the policy. If the maximum tenure of the term plan is 30 years then the coverage continues even after claiming benefit on selected critical illness. Sum that can be used to pay off the remaining balance of your mortgageloan in the event of death andor diagnosis of a critical illness. An insurance policy that decreases.

Source: pinterest.com

Source: pinterest.com

Critical Illness with Term Assurance is designed to pay out a lump sum when the person covered dies or is diagnosed with a terminal illness - where life expectancy is less than 12 months or suffers or undergoes one of the specified critical illnesses or operations during the term of the policy. Term Assurance with Critical Illness Choices NFU Mutual. The term insurance plan is the most basic as well. Any of the persons covered die or are diagnosed with a terminal illness or a critical illness. If the life assured has a critical illness it must be verified by a medical specialist who holds an appointment as a consultant at a hospital in the UK and whose specialism we reasonably consider is appropriate to the critical illness.

Source: pinterest.com

Source: pinterest.com

Assured dies or is diagnosed with a terminal or critical illness. Decreasing Term Assurance And Critical Illness Cover. Any of the persons covered die or are diagnosed with a terminal illness or a critical illness. AIG Critical Illness with Term Assurance is designed to pay out a lump sum when the person covered dies or is diagnosed with a terminal illness - where life expectancy is less than 12 months or suffers or undergoes one of the specified critical illnesses or operations during the term of the policy. Critical Illness with Term Assurance is designed to pay out a lump sum when the person covered dies or is diagnosed with a terminal illness - where life expectancy is less than 12 months or suffers or undergoes one of the specified critical illnesses or operations during the term of the policy.

Source: in.pinterest.com

Source: in.pinterest.com

Term Assurance with Critical Illness Choices NFU Mutual. AIG Critical Illness with Term Assurance is designed to pay out a lump sum when the person covered dies or is diagnosed with a terminal illness - where life expectancy is less than 12 months or suffers or undergoes one of the specified critical illnesses or operations during the term of the policy. Critical illness benefit enables the insured to opt for better treatment process which may not be possible due to limited finance. The Term plan with critical illness rider provides dual coverage of term insurance and critical illness benefit. Assurance shows that it is an insurance product.

Source: tr.pinterest.com

Source: tr.pinterest.com

A term assurance policy is a type of protection insurance. Critical Illness Benefit means the Sum Assured as shown in the Policy Schedule which becomes payable if a Life Assured is diagnosed with an illness or suffers from an accident which results in them meeting all of the claim requirements of one or more of the defined Critical Illness events and definitions. Premiums can be guaranteed throughout the term or reviewable at certain intervals but should you survive the policy term there will be no benefit. If the life assured has a critical illness it must be verified by a medical specialist who holds an appointment as a consultant at a hospital in the UK and whose specialism we reasonably consider is appropriate to the critical illness. This cover can be an add-on benefit to your term assurance policy.

Source: ringgitplus.com

Source: ringgitplus.com

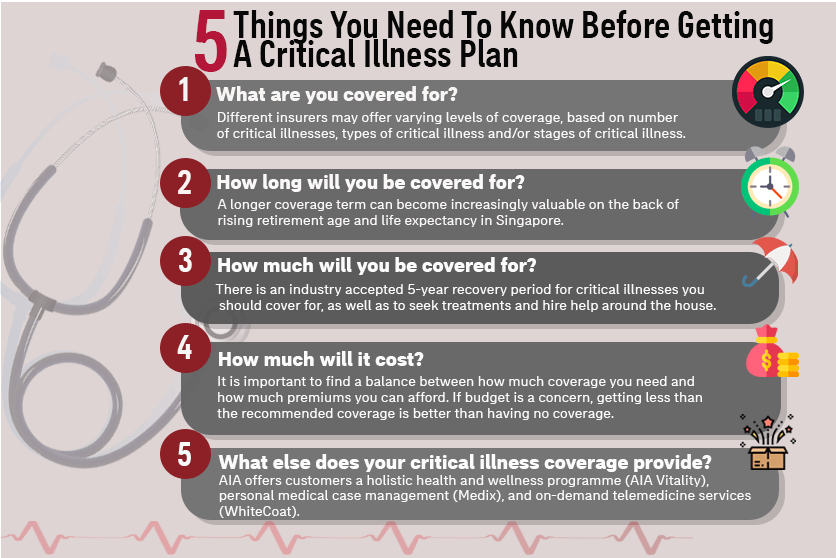

Having a critical illness cover in your term insurance policy works best for ailments like diabetes paralysis artery bypass surgery major organ transplants amongst others. If you make a successful critical illness. Critical Illness Benefit means the Sum Assured as shown in the Policy Schedule which becomes payable if a Life Assured is diagnosed with an illness or suffers from an accident which results in them meeting all of the claim requirements of one or more of the defined Critical Illness events and definitions. Click to open Critical illness cover. Having a critical illness cover in your term insurance policy works best for ailments like diabetes paralysis artery bypass surgery major organ transplants amongst others.

Source: id.pinterest.com

Source: id.pinterest.com

An insurance policy that decreases. Decreasing Term Assurance And Critical Illness Cover. The term insurance plan is the most basic as well. The primary objective to include a critical illness rider in a term plan is to get financial protection for the expensive treatments. What is Level Term Assurance with Critical Illness Cover.

Source: pinterest.com

Source: pinterest.com

Click to open Critical illness cover. Assured dies or is diagnosed with a terminal or critical illness. Decreasing Term Assurance DTA is not an obviously self-explanatory phrase so lets break down the jargon. Term means it has a fixed number of years to run and eventually expires. Is diagnosed with one of the critical illnesses specified in your policy document or dies.