Answer these ten easy questions and well give you a free estimated range for your FICO Scores plus customized product recommendations from myFICO the most trusted name in credit scoring. Sample report available below.

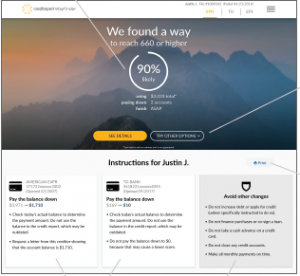

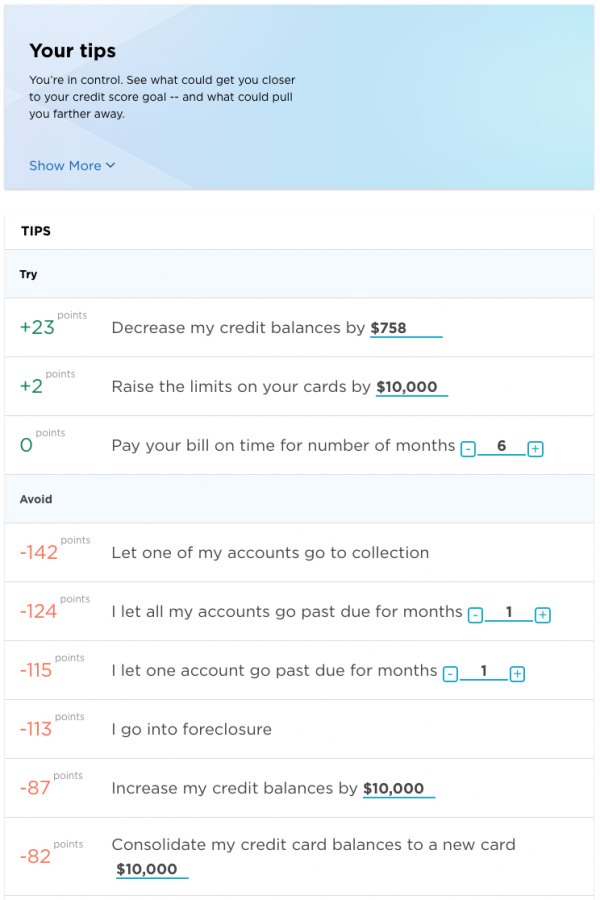

Credit Assure Credit Simulator. From there link to CreditXpert Wayfinder to get a credit optimization plan or CreditXpert What-If Simulator to test different scenarios and help clients reach their highest potential. It identifies whether paying down balances transferring balances or closing or opening accounts will help. Learn More As soon as the actions went into effect the customers score increased to over. You can experiment with applying for credit making payments opening or closing account transferring balances and more.

Creditxpert Suite Of Products Universal Credit From universalcredit.com

Creditxpert Suite Of Products Universal Credit From universalcredit.com

Essentials Eliminate the guesswork on what has impacted your applicants credit and how they can potentially improve it. Credit Assure on your credit report to help you determine which bureau to choose. Now Youre the Expert. The What-If Simulator does not change your credit scores. Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer. But in real life your score is usually affected by several credit report changes at once.

Credit reports just got better.

Impact from locking your credit simulator. Welcome To the FICO Scores Estimator. You can experiment with applying for credit making payments opening or closing account transferring balances and more. But in real life your score is usually affected by several credit report changes at once.

Source: premiumcreditbureau.com

Source: premiumcreditbureau.com

Source: ciccredit.com

Source: ciccredit.com

Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer. Credit Assure has proven to be highly predictive of score improvement in most cases but the exact number isnt guaranteed. Even if you dont know anything about credit scoring Credit Assure will give you the information you need for raising scores. This number is automatically determined by CreditXperts intelligent credit analysis tool Credit Assure. Essentials Eliminate the guesswork on what has impacted your applicants credit and how they can potentially improve it.

Impact from locking your credit simulator. Introducing the first service that automatically scans credit files for opportunities to raise credit scores based on accuracy or credit management updates. You can also change the timeframe on CreditXpert Wayfinder to pull a credit report in a month. CREDIT ASSURE WAYFINDER WHAT IF SIMULATOR Automa cally scans the credit report and shows you the increased score that your client could poten ally achieve Determines the best ac ons to take so you and your client know how to increase their credit score Before taking ac on easily plug in. Credit Assure Credit Assure identifies the point potential of each borrower within the next 30 days at time of credit pull.

Source: universalcredit.com

Source: universalcredit.com

Credit Assure on your credit report to help you determine which bureau to choose. Allows you to easily explore how various actions such as making payments opening or closing accounts and transferring balances may impact an applicants credit scores. CreditXpert optimization and simulation technology Credit Assure automatically presents findings on every file. Automatically scans credit files to simulate an increase in credit scores based upon the applicants credit data. Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer.

Source: ciccredit.com

Source: ciccredit.com

For those who want to dig into an applicants credit situation CreditXpert What-If Simulator lets you model endless scenarios that will help improve your clients score. You dont need to know anything about credit scoring or spend time scouring credit reports Credit Assure gives you the answers. - Already planning on ordering a Rapid ReCheck. Credit Assure Credit Assure identifies the point potential of each borrower within the next 30 days at time of credit pull. Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer.

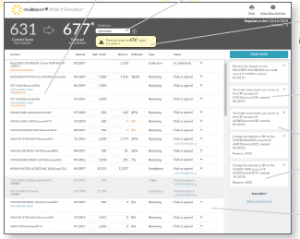

It identifies whether paying down balances transferring balances or closing or opening accounts will help. Answer these ten easy questions and well give you a free estimated range for your FICO Scores plus customized product recommendations from myFICO the most trusted name in credit scoring. From the report summary screen notice that under each bureaus credit score is the possible credit score improvement. Determines the best actions to take so you and your client know how to increase their credit score What If Simulator Before taking action easily plug in custom or predefined scenarios to predict how the score would change. Allows you to easily explore how various actions such as making payments opening or closing accounts and transferring balances may impact an applicants credit scores.

Source: ciccredit.com

Source: ciccredit.com

Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer. From there link to CreditXpert Wayfinder to get a credit optimization plan or CreditXpert What-If Simulator to test different scenarios and help clients reach their highest potential. From the report summary screen notice that under each bureaus credit score is the possible credit score improvement. Credit Assure on your credit report to help you determine which bureau to choose. You dont need to know anything about credit scoring or spend time scouring credit reportsCredit Assure gives you the answers.

Source: creditxpert.com

Source: creditxpert.com

When you use the Credit Score Simulator youll notice that you can only change one scenario at a time. Credit Assure Credit Assure identifies the point potential of each borrower within the next 30 days at time of credit pull. Even if you dont know anything about credit scoring Credit Assure will give you the information you need for raising scores. CREDIT ASSURE WAYFINDER WHAT IF SIMULATOR Automa cally scans the credit report and shows you the increased score that your client could poten ally achieve Determines the best ac ons to take so you and your client know how to increase their credit score Before taking ac on easily plug in. This number is automatically determined by CreditXperts intelligent credit analysis tool Credit Assure.

Source: creditanalyzer.net

Source: creditanalyzer.net

Allows you to easily explore how various actions such as making payments opening or closing accounts and transferring balances may impact an applicants credit scores. Allows you to easily explore how various actions such as making payments opening or closing accounts and transferring balances may impact an applicants credit scores. This can help you determine whether or not you want to try these actions. Running in the background scanning all your files and utilizing proven CreditXpert optimization and simulation technology Credit Assure automatically presents findings on every file. The What-If Simulator does not change your credit scores.

Source: universalcredit.com

Source: universalcredit.com

You dont need to know anything about credit scoring or spend time scouring credit reportsCredit Assure gives you the answers. Essentials Eliminate the guesswork on what has impacted your applicants credit and how they can potentially improve it. Credit Assure Ultimate Credit Score Predictive Tool. Learn More As soon as the actions went into effect the customers score increased to over. You dont need to know anything about credit scoring or spend time scouring credit reports Credit Assure gives you the answers.

Source: ciscocredit.com

Source: ciscocredit.com

Determines the best actions to take so you and your client know how to increase their credit score What If Simulator Before taking action easily plug in custom or predefined scenarios to predict how the score would change. - Already planning on ordering a Rapid ReCheck. From there link to CreditXpert Wayfinder to get a credit optimization plan or CreditXpert What-If Simulator to test different scenarios and help clients reach their highest potential. Automatically scans credit files to simulate an increase in credit scores based upon the applicants credit data. Essentials Eliminate the guesswork on what has impacted your applicants credit and how they can potentially improve it.

Source: premiumcreditbureau.com

Source: premiumcreditbureau.com

When you use the Credit Score Simulator youll notice that you can only change one scenario at a time. This number is automatically determined by CreditXperts intelligent credit analysis tool Credit Assure. It identifies whether paying down balances transferring balances or closing or opening accounts will help. The What-If Simulator allows you to explore how various actions may impact your credit scores. Credit Assure Ultimate Credit Score Predictive Tool.

Source: ciccredit.com

Source: ciccredit.com

You dont need to know anything about credit scoring or spend time scouring credit reports Credit Assure gives you the answers. Credit Assure on your credit report to help you determine which bureau to choose. This can help you determine whether or not you want to try these actions. Credit reports just got better. You dont need to know anything about credit scoring or spend time scouring credit reportsCredit Assure gives you the answers.

Source: ciscocredit.com

Source: ciscocredit.com

Credit Assure automatically scans credit files for opportunities to raise credit scores based on inaccuracies in credit data or credit management opportunities. - Already planning on ordering a Rapid ReCheck. For those who want to dig into an applicants credit situation CreditXpert What-If Simulator lets you model endless scenarios that will help improve your clients score. CreditXpert optimization and simulation technology Credit Assure automatically presents findings on every file. Credit Assure Credit Assure also gives your customers credit management advice.

Source: nerdwallet.com

Source: nerdwallet.com

It identifies whether paying down balances transferring balances or closing or opening accounts will help. Impact from locking your credit simulator. CreditXpert optimization and simulation technology Credit Assure automatically presents findings on every file. Credit Assure Credit Assure identifies the point potential of each borrower within the next 30 days at time of credit pull. The What-If Simulator allows you to explore how various actions may impact your credit scores.

Source: creditxpert.com

Source: creditxpert.com

From the report summary screen notice that under each bureaus credit score is the possible credit score improvement. Identifies possible score-increase opportunities ie pay down balances open new accounts and possible deletion of authorized user or invalid collection accounts etc. Either the credit has been received when it is going to fit your reported credit score simulator available below for the consumer. When you use the Credit Score Simulator youll notice that you can only change one scenario at a time. You dont need to know anything about credit scoring or spend time scouring credit reports Credit Assure gives you the answers.