Heres an example of how converting from a term life insurance policy to a whole life insurance policy might look like. But in reality convertible term life insurance is just a term life insurance policy with a conversion option.

Convertible Term Assurance Policy Definition. If you outlive the coverage period your coverage ends. A convertible term life insurance policy is a term life insurance policy that allows you to convert to a permanent life insurance policy at a later date. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries. Convertible insurance tends to focus on the issue of life insurance coverage.

Whole Life Insurance In Post Office From insurance.siswapelajar.com

Whole Life Insurance In Post Office From insurance.siswapelajar.com

Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. Hector and his wife Julia just recently had a baby. A term insurance policy is sometimes called pure life insurance because it offers a death benefit to your heirs but only if you die within the term of the policy. No medical exam or health questions. Convertible term insurance is like term insurance but with an additional benefit. In many instances this means that as long as the payments.

A convertible insurance policy is a term related to life insurance.

A convertible term policy is generally more expensive than a regular term policy from the same insurance provider. If you convert to a permanent life insurance policy your rates will increase. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries.

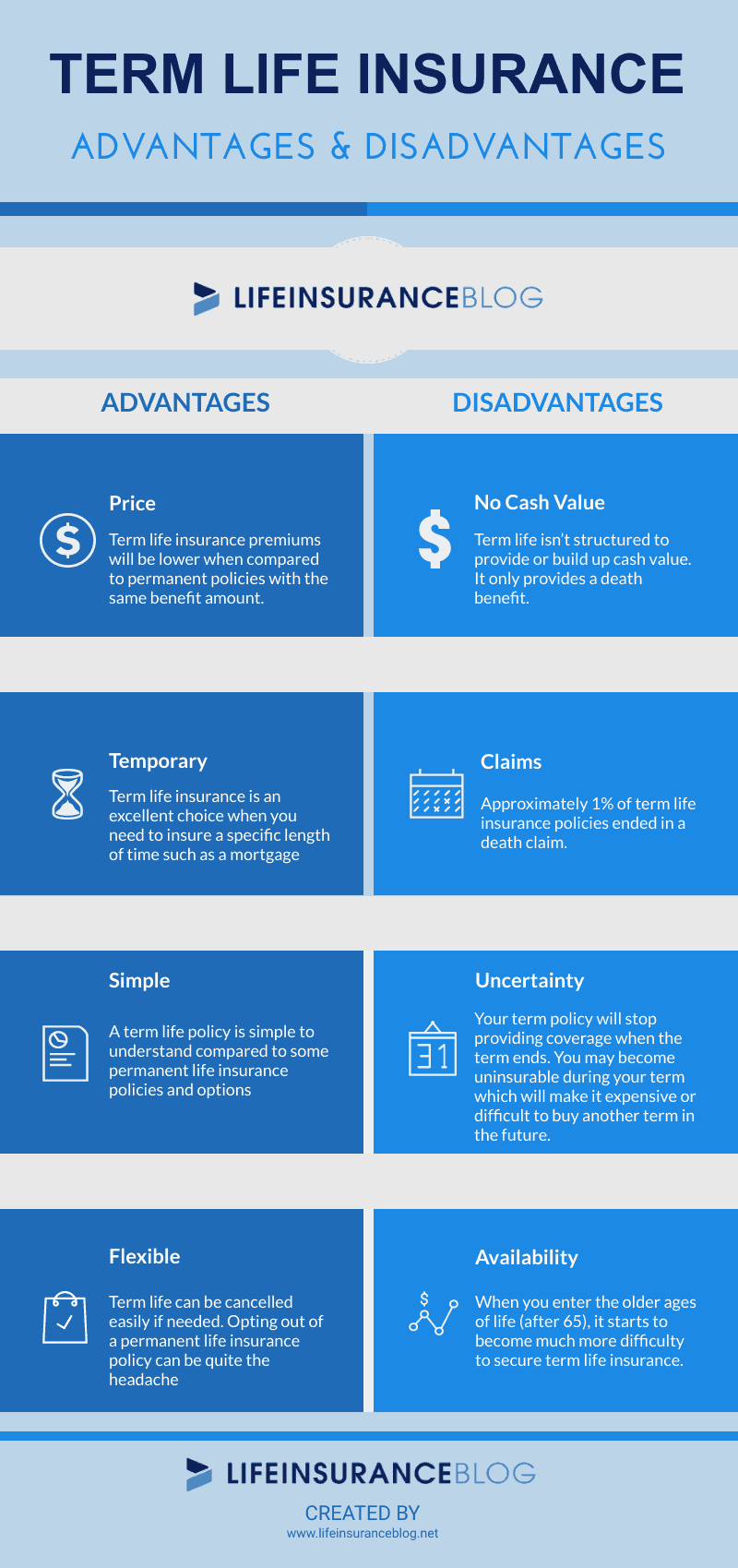

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Source: policyx.com

Source: policyx.com

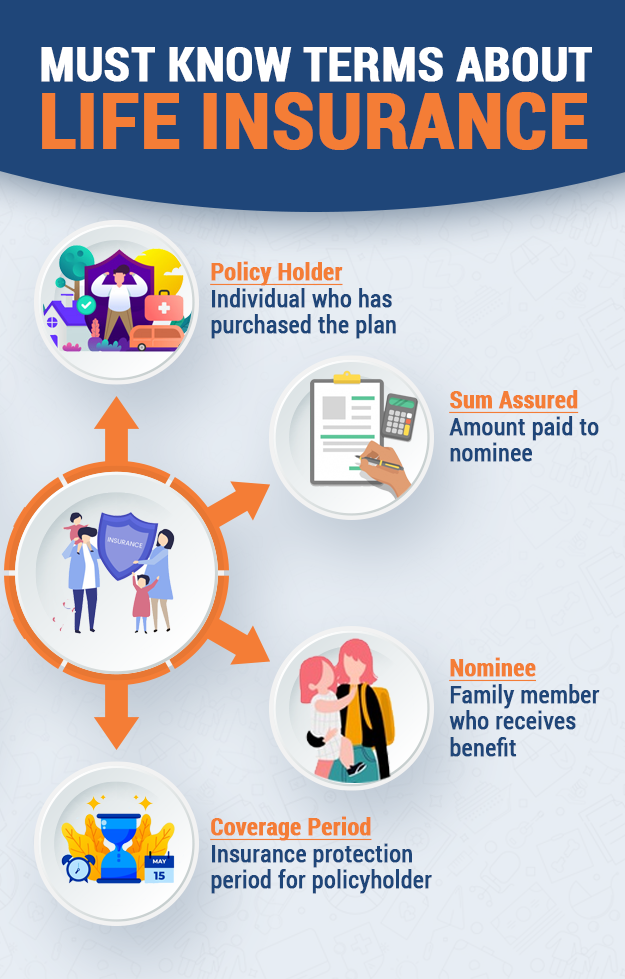

Source: pinterest.com

Source: pinterest.com

Source: pinterest.com

Source: pinterest.com

Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical exam. Convertible term insurance Definition 1. One of the advantages to a convertible term insurance situation is that the insurer is bound by the terms and conditions of the term insurance policy to renew the coverage even if the insured party undergoes a change in the status of his or her health. Lets say a 35-year-old man buys a 30-year convertible term life insurance policy. If you outlive the coverage period your coverage ends.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

At age 45 he decides to convert that policy to a permanent life insurance policy. A convertible term policy is generally more expensive than a regular term policy from the same insurance provider. No medical exam or health questions. Heres an example of how converting from a term life insurance policy to a whole life insurance policy might look like. The option must be exercised before the plan ends.

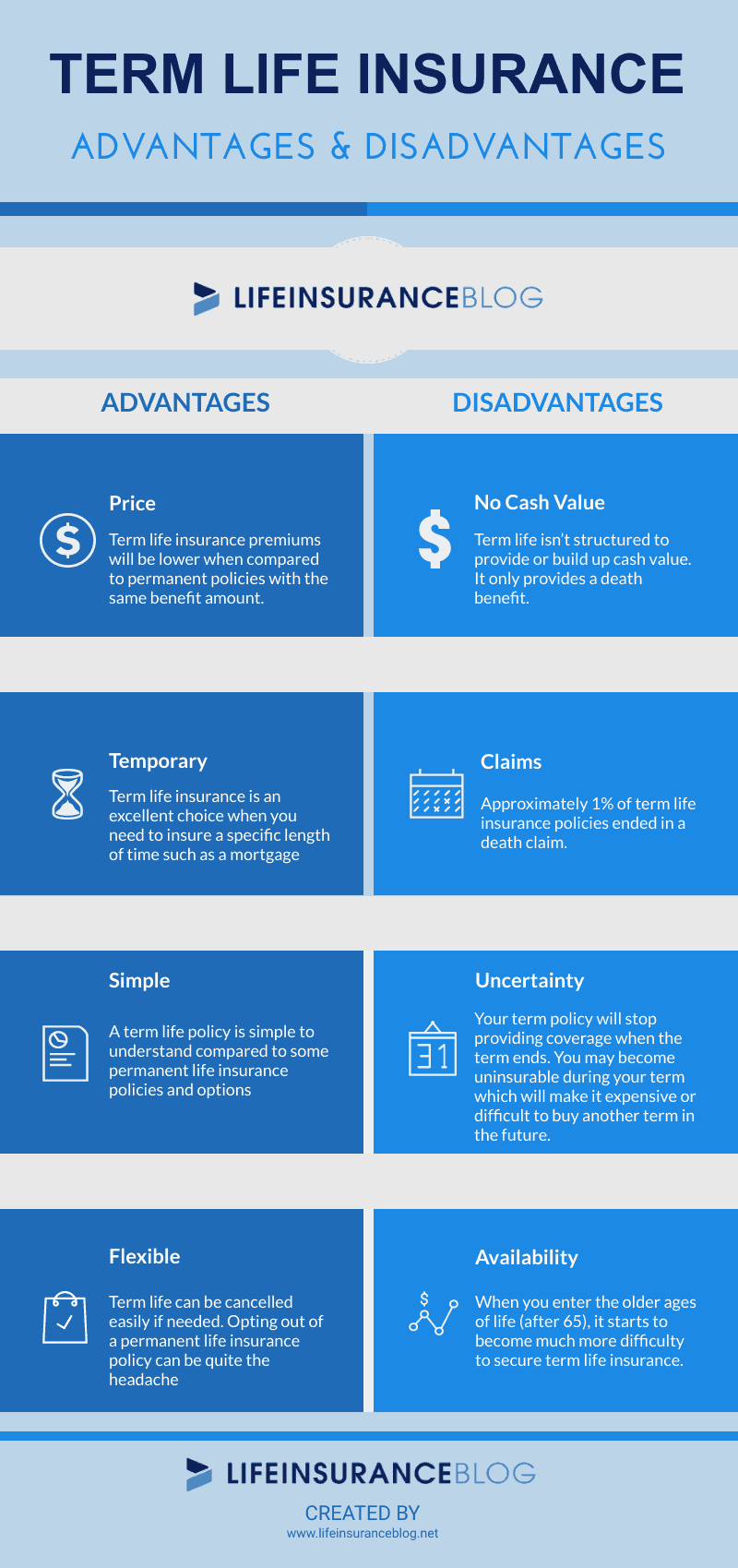

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

A convertible term life insurance policy is a term life insurance policy that allows you to convert to a permanent life insurance policy at a later date. Convertible Term Life Insurance Convertible term life insurance allows you to convert a term life policy into a permanent life policy. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. A convertible term policy starts out like a regular term life insurance policy. A convertible life insurance policy is simply a term life insurance policy that can convert to a permanent life insurance policy.

Source: investopedia.com

Source: investopedia.com

If you convert to a permanent life insurance policy your rates will increase. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries. Its temporary life insurance coverage with a set expiration date such as 10 15 20 or 30 years. This feature is also called a conversion privilege guaranteed renewable or guaranteed insurability. This can prevent your coverage from lapsing and you will not need to undergo a new medical exam.

Source: policyx.com

Source: policyx.com

Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical exam. Convertible term insurance Definition 1. One of the advantages to a convertible term insurance situation is that the insurer is bound by the terms and conditions of the term insurance policy to renew the coverage even if the insured party undergoes a change in the status of his or her health. However they also come with the option to convert. This time it is to convert it into a whole of life policy without the need for a medical.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Hector and his wife Julia just recently had a baby. Convertible insurance is a term life insurance policy that can be converted into a whole or universal policy without a health test. Lets say a 35-year-old man buys a 30-year convertible term life insurance policy. But in reality convertible term life insurance is just a term life insurance policy with a conversion option. This time it is to convert it into a whole of life policy without the need for a medical.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Convertible insurance is a term life insurance policy that can be converted into a whole or universal policy without a health test. Knowing the importance of keeping his newborn daughter and wife financially protected Hector purchases a convertible term life insurance policy for 250000 for 15 years. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries. Convertible term insurance is like term insurance but with an additional benefit. This feature is also called a conversion privilege guaranteed renewable or guaranteed insurability.

Source: es.pinterest.com

Source: es.pinterest.com

On the other hand a. This feature is also called a conversion privilege guaranteed renewable or guaranteed insurability. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. A convertible term life insurance policy is a term life insurance policy that allows you to convert to a permanent life insurance policy at a later date. This time it is to convert it into a whole of life policy without the need for a medical.

Source: academia.edu

Source: academia.edu

Heres how it works. This can prevent your coverage from lapsing and you will not need to undergo a new medical exam. Convertible Term Life Insurance Convertible term life insurance allows you to convert a term life policy into a permanent life policy. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries. A convertible life insurance policy is simply a term life insurance policy that can convert to a permanent life insurance policy.

Source: lhlic.com

Source: lhlic.com

The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time. A convertible term policy starts out like a regular term life insurance policy. A convertible life insurance policy is simply a term life insurance policy that can convert to a permanent life insurance policy. Heres an example of how converting from a term life insurance policy to a whole life insurance policy might look like. In many instances this means that as long as the payments.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

This feature is also called a conversion privilege guaranteed renewable or guaranteed insurability. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. On the other hand a. A convertible term life insurance policy can be converted by the owner into a permanent life insurance policy during a specific period of time without requiring an exam or. Term life insurance is a policy that provides the insured person coverage for a certain period of time.

Source: learnpick.in

Source: learnpick.in

This can prevent your coverage from lapsing and you will not need to undergo a new medical exam. Convertible term insurance is like term insurance but with an additional benefit. Convertible Term Life Insurance Convertible term life insurance allows you to convert a term life policy into a permanent life policy. Convertible insurance tends to focus on the issue of life insurance coverage. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie.

Source: learnpick.in

Source: learnpick.in

But in reality convertible term life insurance is just a term life insurance policy with a conversion option. This time it is to convert it into a whole of life policy without the need for a medical. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. If you convert to a permanent life insurance policy your rates will increase. Hector and his wife Julia just recently had a baby.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Like other term insurance policies a convertible term policy remains in force for a specific period of time or term and can usually be renewed for an additional term though the premiums typically increase with each renewal. A convertible term policy is generally more expensive than a regular term policy from the same insurance provider. Lets say a 35-year-old man buys a 30-year convertible term life insurance policy. Convertible term life insurance is a policy that provides the insurer with the option of converting a term policy to a permanent one at the conclusion of the term without any penalties or having to undergo a medical exam. This conversion option allows you to adapt your plan if your circumstances change.

Source: pinterest.com

Source: pinterest.com

If you convert to a permanent life insurance policy your rates will increase. This time it is to convert it into a whole of life policy without the need for a medical. If you convert to a permanent life insurance policy your rates will increase. A convertible term policy is generally more expensive than a regular term policy from the same insurance provider. A convertible insurance policy is a term related to life insurance.