However the benefits might change. Click to open Decreasing term assurance.

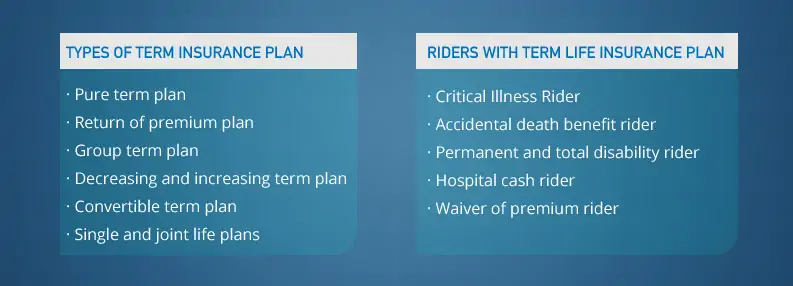

Convertible Term Assurance Policy. Convertible term insurance is like term insurance but with an additional benefit. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. Even after the conversion the premium will remain the same. This type of cover is cheaper than level term due.

Convertible Term Life Insurance From insuranceandestates.com

Convertible Term Life Insurance From insuranceandestates.com

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. This type of policy is useful to cover a reducing loan such as a repayment mortgage if you die during the term. However they also come with the option to convert. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. On the other hand a. This conversion option allows you to adapt your plan if your circumstances change.

Click to open Decreasing term assurance.

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance. Rather than choosing a traditional term life policy and watching as it expires the conversion rider provides an option for what happens after whether it renews year-by-year or converts into a permanent option. This type of cover is cheaper than level term due.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Source: coverfox.com

Source: coverfox.com

Source: kamuslengkap.com

Source: kamuslengkap.com

Convertible term assurance policies are life assurance policies with a specified term. On the other hand a. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. Rather than choosing a traditional term life policy and watching as it expires the conversion rider provides an option for what happens after whether it renews year-by-year or converts into a permanent option.

Source: kamuslengkap.com

Source: kamuslengkap.com

This type of policy is useful to cover a reducing loan such as a repayment mortgage if you die during the term. 100 of Sum Assured is payable in one lump sum. The premium paid on the insurance plan can be converted later into a whole life policy or an endowment insurance policy. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. However they also come with the option to convert.

Source: myinsuranceclub.com

Source: myinsuranceclub.com

We advise you to read the actual policy documents for important details on coverage exclusions. However the benefits might change. Its also known as a conversion option as part of a term life insurance policy. Please note that this brief summary is not a policy document. Life cover decreases during the term of the policy.

Source: nilife.com

Source: nilife.com

Converting part of your policy can help you meet your goals and manage your budget. Click to open Decreasing term assurance. The convertible term insurance premium is determined at the initiation of the plan. This plan is specifically designed for those individuals for whom a high premium is not affordable. Convertible term assurance policies are life assurance policies with a specified term.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

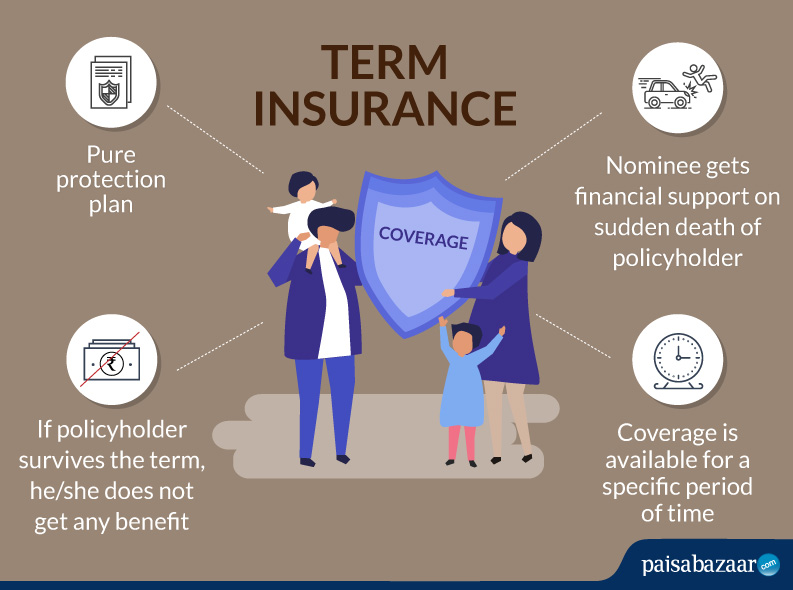

We advise you to read the actual policy documents for important details on coverage exclusions. A convertible insurance policy is a term related to life insurance. It gives you the flexibility to keep your life cover in place if. The convertible term insurance premium is determined at the initiation of the plan. Term life insurance is a policy that provides the insured person coverage for a certain period of time.

Source: paisabazaar.com

Source: paisabazaar.com

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. In a term insurance plan at the maturity of the policy no benefit is paid. Its also known as a conversion option as part of a term life insurance policy. No medical exam or health questions. Converting part of your policy can help you meet your goals and manage your budget.

Source: slideshare.net

Source: slideshare.net

100 of Sum Assured is payable in one lump sum. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie. Its also known as a conversion option as part of a term life insurance policy. Rather than choosing a traditional term life policy and watching as it expires the conversion rider provides an option for what happens after whether it renews year-by-year or converts into a permanent option. Any 5 years term policy is renewable without any medical evidence.

Source: insuranceandestates.com

Source: insuranceandestates.com

Life cover decreases during the term of the policy. It gives you the flexibility to keep your life cover in place if. Convertible term assurance policies are life assurance policies with a specified term. We advise you to read the actual policy documents for important details on coverage exclusions. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie.

Source: wishpolicy.com

Source: wishpolicy.com

Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance. LIC Convertible Term Assurance plan is a term insurance plan which offers affordable and low premiums. Convertible Term Assurance Policy Table No. This type of policy is useful to cover a reducing loan such as a repayment mortgage if you die during the term. All things considered both renewable and convertible term life insurance policies can be useful to the right people.

Source: learnpick.in

Source: learnpick.in

Convertible term assurance policies are life assurance policies with a specified term. The option must be exercised before the plan ends. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. This type of cover is cheaper than level term due. This time it is to convert it into a whole of life policy without the need for a medical.

Source: paisabazaar.com

Source: paisabazaar.com

Life cover decreases during the term of the policy. This plan is specifically designed for those individuals for whom a high premium is not affordable. LIC Convertible Term Assurance plan is a term insurance plan which offers affordable and low premiums. Convertible into whole life or endowment plan without medical evidence. On the other hand a.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Convertible term assurance policies are life assurance policies with a specified term. If you choose to exercise this option it allows you to convert all or a portion of the existing death benefit to permanent insurance coverage such as whole life or universal life with no evidence of insurability required ie. Convertible term assurance is a type of policy that allows you to convert to a whole of life policy at the end of its term without providing new medical information. It gives you the flexibility to keep your life cover in place if. Converting part of your policy can help you meet your goals and manage your budget.

Source: kamuslengkap.com

Source: kamuslengkap.com

Convertible term insurance is like term insurance but with an additional benefit. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Life cover decreases during the term of the policy. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time of the conversion. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time.

Source: everquote.com

Source: everquote.com

This time it is to convert it into a whole of life policy without the need for a medical. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. All things considered both renewable and convertible term life insurance policies can be useful to the right people. Convertible term insurance is like term insurance but with an additional benefit. This plan is specifically designed for those individuals for whom a high premium is not affordable.

Source: kamuslengkap.com

Source: kamuslengkap.com

Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Convertible Term Assurance Policy holders get an option of converting an policy into endowment assurance or limited payment whole life assurance. Once the term has expired the policyholder usually has the choice to convert the policy to a different type of contract which can be a further term assurance policy an endowment or a whole of life assurance policy. Its also known as a conversion option as part of a term life insurance policy. Convertible term insurance lets you trade in a temporary policy for a permanent one.