Term life insurance is a policy that provides the insured person coverage for a certain period of time. Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary.

Convertible Term Assurance Explained. Knowing the importance of keeping his newborn daughter and wife financially protected Hector purchases a convertible term life insurance policy for 250000 for 15 years. The option must be exercised before the plan ends. Term life insurance lasts a specific period such as 10 20 or 30 years and your beneficiary gets a payout from the insurer if you die within that timeframe. If you do convert to whole-of-life cover your premiums will almost certainly increase as this way youll have a guaranteed pay-out.

Convertible Term Assurance What Does It Mean Reassured From reassured.co.uk

Convertible Term Assurance What Does It Mean Reassured From reassured.co.uk

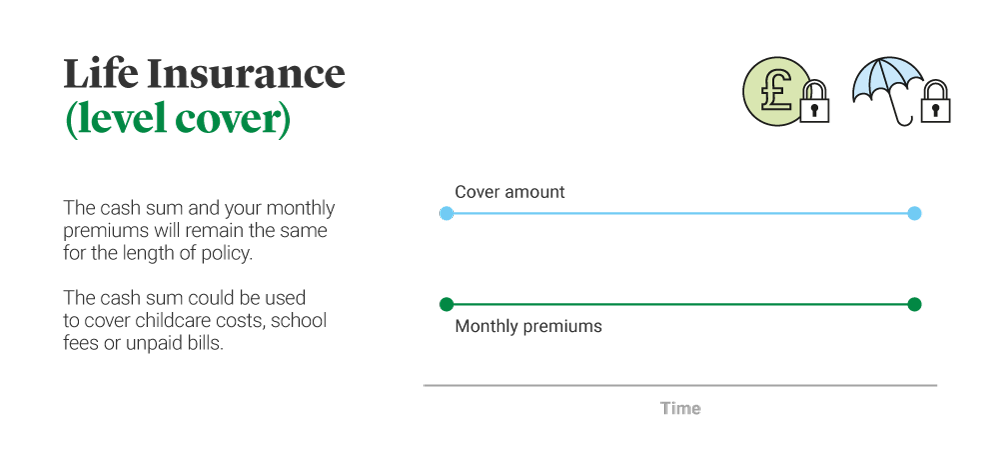

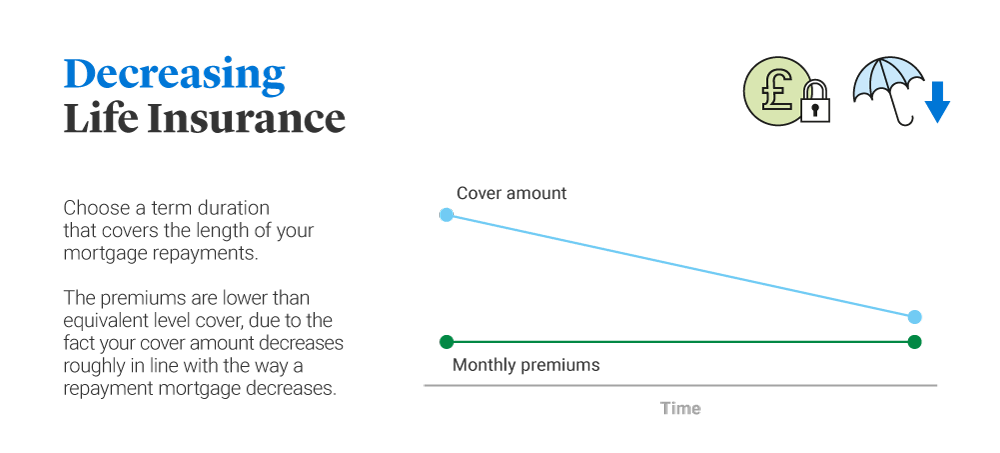

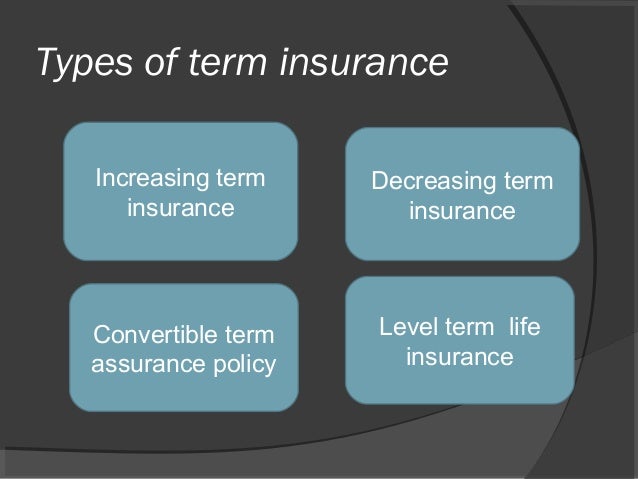

Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. Interest rate conversion discount and valuation cap. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. If you outlive the coverage period your coverage ends. A convertible term policy gives the insured an option to covert a term policy to a permanent whole life policy at a later date. There are several types of Term Assurance.

Knowing the importance of keeping his newborn daughter and wife financially protected Hector purchases a convertible term life insurance policy for 250000 for 15 years.

This enables you to covert the cover under the policy into a new policy running for a longer period of time without having to undergo a medical examination or supply evidence of good health at the time of the conversion. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time of the conversion. This conversion option allows you to adapt your plan if your circumstances change. The option must be exercised before the plan ends.

Source: quotacy.com

Source: quotacy.com

Source: claritywealth.co.uk

Source: claritywealth.co.uk

Source:

Source:

Source: reassured.co.uk

Source: reassured.co.uk

If you do convert to whole-of-life cover your premiums will almost certainly increase as this way youll have a guaranteed pay-out. If the life insured dies during the term the death benefit will be paid to the beneficiary. With convertible term life insurance you have a conversion option available to you at any time during the term of the policy. The policy is for a set period of time typically ranging from annual renewable term 1 year 5 years 10 15 20. There are several types of Term Assurance.

Source: learnpick.in

Source: learnpick.in

The option must be exercised before the plan ends. Convertible term life insurance allows a term insurance policy which has a limited number of years before expiring to convert into whole life or permanent insurance. A convertible insurance policy is a term related to life insurance. Fast forward 14 years Hector gets a letter saying his term life insurance policy is going to end after the year is up. If you die within the coverage period the policy will pay out the death benefit to your beneficiaries.

Source: lion.ie

Source: lion.ie

Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary. The sum assured under the policy is only paid out if death occurs within a specified term. The convertible term insurance plans are not that easily accessible in the Indian marketAs the market is not flooded with many options therefore selecting the right plan and the choices also remain limited. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time of the conversion. Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary.

Source: bankbazaar.com

Source: bankbazaar.com

Convertible term insurance is like term insurance but with an additional benefit. This time it is to convert it into a whole of life policy without the need for a medical. A convertible insurance policy is a term related to life insurance. If you do convert to whole-of-life cover your premiums will almost certainly increase as this way youll have a guaranteed pay-out. However they also come with the option to convert.

Source: learnpick.in

Source: learnpick.in

Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary. This life cover is virtually the same as Level Term Assurance but it also carries the right to be able to convert it to a permanent whole of life policy or maybe another Term Assurance or endowment life policy during the term of the policy. This time it is to convert it into an endowment or whole of life policy without the need for a medical. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. In this article were going to cover the three most common terms youll come across in a convertible note.

Source: claritywealth.co.uk

Source: claritywealth.co.uk

A convertible term policy is typically a level term life insurance policy with a level death benefit for a specific term. Convertible term life insurance allows a term insurance policy which has a limited number of years before expiring to convert into whole life or permanent insurance. A convertible insurance policy is a term related to life insurance. The policyholder has a conversion option which means they can convert the cover under the policy into a new policy running for a longer period of time without the insured person having to undergo a medical examination or supply evidence of good health at the time of the conversion. Convertible Term Assurance CTA.

Source: wishpolicy.com

Source: wishpolicy.com

This time it is to convert it into an endowment or whole of life policy without the need for a medical. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Convertible term life insurance allows a term insurance policy which has a limited number of years before expiring to convert into whole life or permanent insurance. If you outlive the coverage period your coverage ends. Term life insurance lasts a specific period such as 10 20 or 30 years and your beneficiary gets a payout from the insurer if you die within that timeframe.

Source:

Source:

Convertible term life insurance allows a term insurance policy which has a limited number of years before expiring to convert into whole life or permanent insurance. This conversion option allows you to adapt your plan if your circumstances change. Knowing the importance of keeping his newborn daughter and wife financially protected Hector purchases a convertible term life insurance policy for 250000 for 15 years. This time it is to convert it into a whole of life policy without the need for a medical. The option must be exercised before the plan ends.

Source: bankbazaarinsurance.com

Source: bankbazaarinsurance.com

Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. The convertible term insurance plan premium is higher than for a normal term life insurance planThe reason behind higher premiums is the promise of the maturity. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. With a convertible note the investor loans money to the startup in return for equity in the company rather than a a payout of the principal plus interest. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term.

There are several types of Term Assurance. If the life assured survives until the end of the term the policy will expire and there will be no monies payable. This time it is to convert it into an endowment or whole of life policy without the need for a medical. On the other hand a. A convertible term policy starts out like a regular term life insurance policy.

Source: learnpick.in

Source: learnpick.in

On the other hand a. There are several types of Term Assurance. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. Term Assurance is life insurance in its cheapest form. Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary.

Source: quotacy.com

Source: quotacy.com

Convertible term insurance is like term insurance but with an additional benefit. The policy is for a set period of time typically ranging from annual renewable term 1 year 5 years 10 15 20. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. If the life assured survives until the end of the term the policy will expire and there will be no monies payable. Interest rate conversion discount and valuation cap.

Source: youtube.com

Source: youtube.com

There are several types of Term Assurance. Like Renewable Term Assurance this type of term assurance contains an option at the end of the term. If the life insured dies during the term the death benefit will be paid to the beneficiary. Alternatively permanent life insurance never expires so long as premiums are paid. A convertible term policy starts out like a regular term life insurance policy.

Source: slideshare.net

Source: slideshare.net

There are several types of Term Assurance. Convertible term assurance policies are similar to term assurance policies as they have a known level of cover that will pay out in the event of death within a set time. Its temporary life insurance coverage with a set expiration date such as 10 15 20 or 30 years. A convertible term policy is typically a level term life insurance policy with a level death benefit for a specific term. Term life insurance is defined as a contract between the owner of the policy and the insurer for a policy on the life of the insured whereupon the insureds death the insurer pays a lump sum death benefit to the beneficiary.

Source: learnpick.in

Source: learnpick.in

Alternatively permanent life insurance never expires so long as premiums are paid. If the life insured dies during the term the death benefit will be paid to the beneficiary. Also known as convertible-term life insurance this type of policy lets you switch your plan to a whole-of-life insurance policy even if there have been changes to your circumstances. If you do convert to whole-of-life cover your premiums will almost certainly increase as this way youll have a guaranteed pay-out. Its temporary life insurance coverage with a set expiration date such as 10 15 20 or 30 years.