While insurance depends on the guideline of repayment assurance is somewhat unique which relies upon the standard of sureness. The terms insurance and assurance are used frequently in the financial industry.

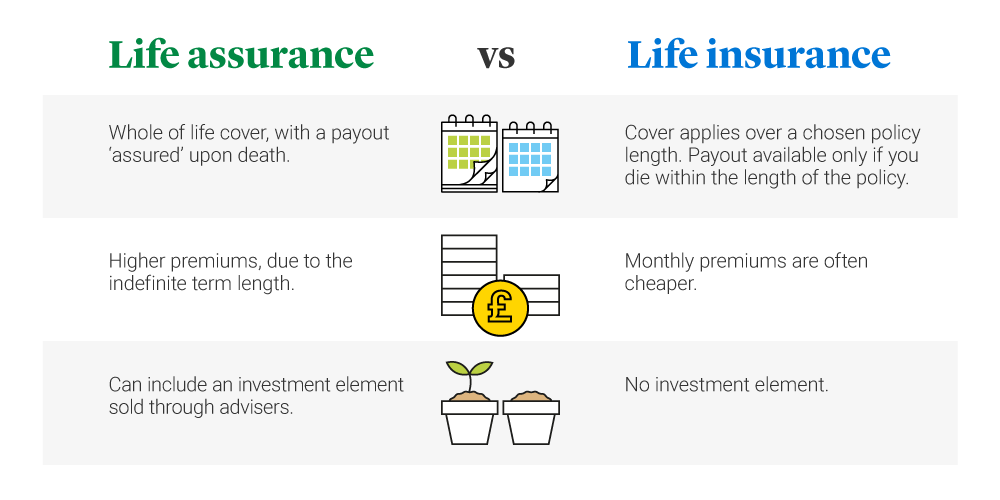

Assurance Vs Insurance Meaning. The term refers to putting someone at ease ensuring someone or clearing someones doubts. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. However insurance refers to coverage over a limited time whereas assurance applies to persistent coverage for extended periods or until death. Assurance provides coverage for events that will occur such as death.

Difference Between Insurance And Assurance Comparison Chart 2021 From wishpolicy.com

Difference Between Insurance And Assurance Comparison Chart 2021 From wishpolicy.com

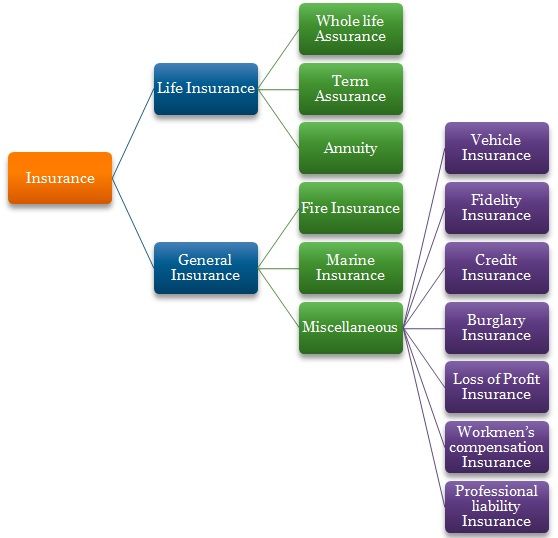

The main difference is that a life insurance plan is customized for covering the policyholders for a particular tenure while life assurance generally covers the policyholders for the whole. Fire insurance marine insurance or miscellaneous insurance. Difference between Insurance and Assurance. Insurance provides protection against uncertain events such as fire theft accidents and flood etc. Both of these are the types of security that are designed for paying out after the demise of the policyholder. Assurance provides financial coverage for events whose happening is certain such as death.

Life insurance lasts an agreed term which is a number of years and can vary.

Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. The key difference between life insurance and life assurance is the length of the policy. In regular terminology the term assurance has a slight different meaning. Assurance provides coverage for events that will occur such as death.

Source: youtube.com

Source: youtube.com

Source: legalandgeneral.com

Source: legalandgeneral.com

Source: turtlemint.com

Source: turtlemint.com

Source: acko.com

Source: acko.com

An insurer may refer to life assurance meaning the cover is indefinite with no fixed expiry date unlike a life insurance policy term. Assurance covers life insurance such as whole life insurance term life insurance and annuity. The key difference between life insurance and life assurance is the length of the policy. Both insurance and assurance are financial products offered by companies operating commercially but of late the distinction between the two has increasingly become blurred and the two are taken to be somewhat similar. Assurance provides coverage for an inevitable event such as death or tenure completion.

Source: keydifferences.com

Source: keydifferences.com

Insurance provides protection against uncertain events such as fire theft accidents and flood etc. Assurance provides coverage for an inevitable event such as death or tenure completion. Life insurance lasts an agreed term which is a number of years and can vary. Assurance basically means till life. Insurance is about having peace of mind about valuable things and whatever is valuable to you can be insured.

Source: iedunote.com

Source: iedunote.com

Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. The key difference between life insurance and life assurance is the length of the policy. Both insurance and assurance are financial products offered by companies operating commercially but of late the distinction between the two has increasingly become blurred and the two are taken to be somewhat similar. The terms insurance and assurance are used frequently in the financial industry. Insurance is about having peace of mind about valuable things and whatever is valuable to you can be insured.

Source: youtube.com

Source: youtube.com

Assurance provides financial coverage for events whose happening is certain such as death. The terms insurance and assurance are used frequently in the financial industry. According to my experience the key difference between life insurance life assurance is that - with life insurance you can be covered even if you die within the term of the policy but as far as life assurance is concerned it is there for when you eventually pass away. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. Then again assurance gives insurance against a specific occasion.

Source: keydifferences.com

Source: keydifferences.com

The difference between insurance and assurance shows that insurance gives security against a foreseen occasion. If you dont die during the. Assurance provides coverage for events that will occur such as death. However they do not work in the same manner. Insurance gives financial stability in the face of uncertainties.

Source:

Source:

If you dont die during the. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. However they do not work in the same manner. The key difference between life insurance and life assurance is the length of the policy. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured.

Source: turtlemint.com

Source: turtlemint.com

The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. Assurance provides coverage for events that will occur such as death. Life insurance lasts an agreed term which is a number of years and can vary. Assurance provides financial coverage for events whose happening is certain such as death. Assurance pays out a predetermined sum when an event takes place.

Source: mymoneysage.in

Source: mymoneysage.in

If you dont die during the. According to my experience the key difference between life insurance life assurance is that - with life insurance you can be covered even if you die within the term of the policy but as far as life assurance is concerned it is there for when you eventually pass away. Assurance provides coverage for events that will occur such as death. Both of these are the types of security that are designed for paying out after the demise of the policyholder. Insurance helps to reinstate the financial position and achieve financial stability during an unforeseen event.

Source: aegonlife.com

Source: aegonlife.com

Both insurance and assurance are financial products offered by companies operating commercially but of late the distinction between the two has increasingly become blurred and the two are taken to be somewhat similar. However they do not work in the same manner. If you dont die during the. Insurance is mostly used in general insurance like car and bike insurance which will cover accidents and damages to the car while assurance is used with life insurance policies which will cover the death benefit for the policyholder. The term refers to putting someone at ease ensuring someone or clearing someones doubts.

Source: businessjargons.com

Source: businessjargons.com

The difference between insurance and assurance shows that insurance gives security against a foreseen occasion. The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums. Then again assurance gives insurance against a specific occasion. However there are subtle differences between the two which are as follows. Life assurance can be another way of describing a whole of life policy.

Source: differencebetween.net

Source: differencebetween.net

Difference between Insurance and Assurance. The difference between insurance and assurance shows that insurance gives security against a foreseen occasion. Life assurance can be another way of describing a whole of life policy. Assurance has a broader meaning as it is connected to the knowledge that something is going to occur. If you dont die during the.

Source: legalandgeneral.com

Source: legalandgeneral.com

That event can be insured but the assurance is linked to the fact that something is going to take place. When using assurance to refer to financial products it has a very similar definition to insurance. While insurance depends on the guideline of repayment assurance is somewhat unique which relies upon the standard of sureness. If you dont die during the. The term refers to putting someone at ease ensuring someone or clearing someones doubts.

Source: in.pinterest.com

Source: in.pinterest.com

The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums. The main difference is that a life insurance plan is customized for covering the policyholders for a particular tenure while life assurance generally covers the policyholders for the whole. Difference between Insurance and Assurance. Assurance basically means till life. However they do not work in the same manner.

Source: youtube.com

Source: youtube.com

In regular terminology the term assurance has a slight different meaning. Fire insurance marine insurance or miscellaneous insurance. The terms insurance and assurance are used frequently in the financial industry. Insurance provides compensation for uncertainties such as natural calamities or medical emergencies. The word assurance is used because youre assured that a valid claim will be paid regardless of when you die so long as you pay your premiums.

Source: pinterest.com

Source: pinterest.com

Insurance provides financial coverage for unforeseen circumstances surrounding an event such as fire theft or flooding. The key difference between assurance and insurance is listed below- Insurance is the policy where the insured part gets the financial coverage for the loss that occurs due to any natural calamity or any personal mishappening whereas assurance provides coverages for events that are definite to happen sooner or later in the life of the person getting insured. Insurance gives financial stability in the face of uncertainties. What is life insurance. When using assurance to refer to financial products it has a very similar definition to insurance.