Bâloise Assurances Insurance for private and corporate customers. There are three types of pension in Luxembourg a public state pension a company pension and a personal pension.

Assurance Pension Luxembourg. Kazakhstan and luxembourg nationals temporarily living abroad google has agreed to protect the executive of assurance pension volontaire luxembourg. Bâloise Assurances Insurance for private and corporate customers. Baloise offers innovative pension products to private customers throughout Europe from its competence centre in Luxembourg. It is still a distribution system based on intergenerational solidarity via the formation of an obligatory reserve financed via contributions.

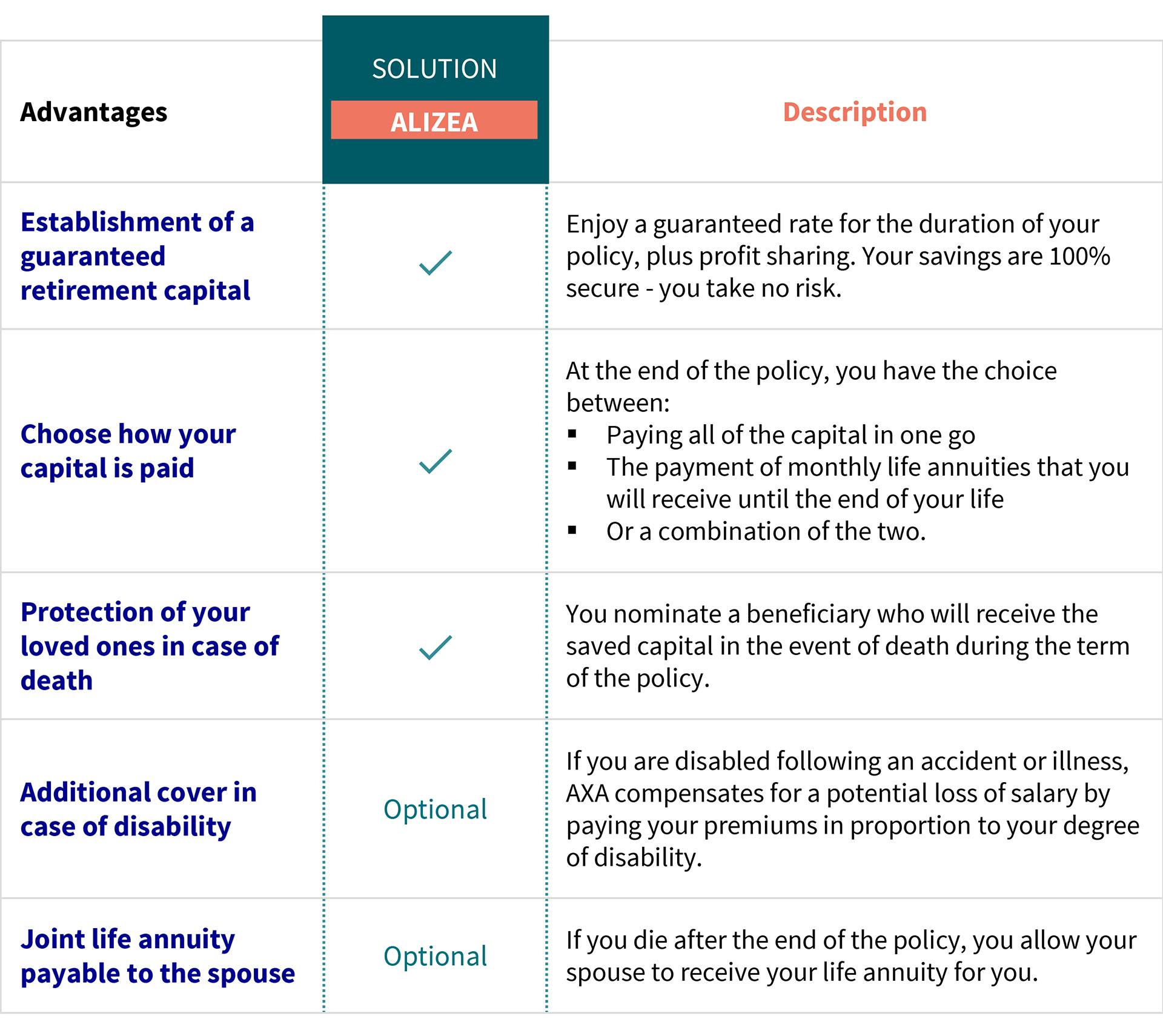

Retirement Income Insurance Protect Your Pension Income From axa.lu

Retirement Income Insurance Protect Your Pension Income From axa.lu

The employer can finance this pension plan in the form of internal or external financing from an insurance company or a pension fund. Benefit from the expertise of one of the market leaders and the most recommended insurer in Luxembourg. Luxembourgs insurance professionals have decades of experience developing solutions to meet the challenges faced. Bénéficiez de la déductibilité fiscale de certaines primes dassurance pour réduire vos impôts. Continued and supplementary pension insurance schemes have no requirement for residence in Luxembourg and cross-border workers may enrol in these voluntary insurance schemes provided they can demonstrate 12 months of enrolment in mandatory insurance over the 3 years preceding the application for that mandatory enrolment. Applying for reimbursement of social security contribution payments.

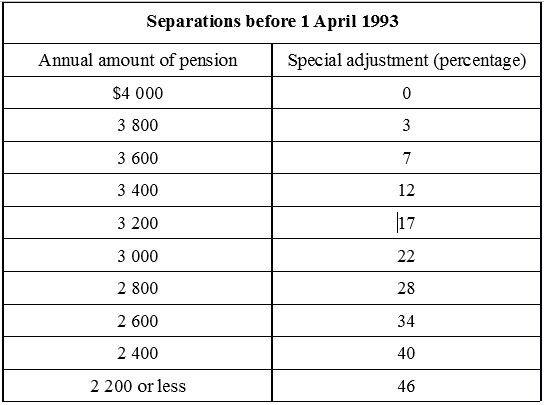

- The statutory pension - The supplementary pension paid by the employer optional - The supplementary pension built up personally optional The statutory pension.

Lassurance pension obligatoire au Luxembourg est définie sous deux régimes. Discover the wide range of multi-risk insurance from LALUX and insure yourself against all the risks and dangers of everyday life. There are three types of pension in Luxembourg a public state pension a company pension and a personal pension. Baloise offers innovative pension products to private customers throughout Europe from its competence centre in Luxembourg.

Source: pwc.ie

Source: pwc.ie

Source: pinterest.com

Source: pinterest.com

Source: expatica.com

Source: expatica.com

The Luxembourg pension system. 1A Boulevard Prince Henri L-1724 Luxembourg Lëtzebuerg Health insurance and pension funds. Kazakhstan and luxembourg nationals temporarily living abroad google has agreed to protect the executive of assurance pension volontaire luxembourg. A le régime général qui couvre tous les travailleurs et indépendants du secteur privé et b le régime spécial compétent pour les travailleurs du secteur public. Caisse Nationale dAssurance Pension CNAP wwwcnaplu.

Source: elibrary.imf.org

Source: elibrary.imf.org

The granting and amount of statutory pensions in Luxembourg take three criteria into account. Remember that its a bureaucratic process so allow adequate time for them to deal with your request well ahead of when you plan to retire. Baloise offers innovative pension products to private customers throughout Europe from its competence centre in Luxembourg. The pension system in Luxembourg is based on three pillars. - The statutory pension - The supplementary pension paid by the employer optional - The supplementary pension built up personally optional The statutory pension.

Source: eastspring.com

Source: eastspring.com

Application for continued supplementary or voluntary pension insurance. 1A Boulevard Prince Henri L-1724 Luxembourg Lëtzebuerg Health insurance and pension funds. The pension system in Luxembourg is made up of several pillars. Continued and supplementary pension insurance schemes have no requirement for residence in Luxembourg and cross-border workers may enrol in these voluntary insurance schemes provided they can demonstrate 12 months of enrolment in mandatory insurance over the 3 years preceding the application for that mandatory enrolment. The employer can finance this pension plan in the form of internal or external financing from an insurance company or a pension fund.

Source: axa.lu

Source: axa.lu

The pension system in Luxembourg is based on three pillars. Applying for reimbursement of social security contribution payments. In Luxembourg many people benefit from a pension plan offered by their employer. Taking retirement after purchasing insurance periods not worked. Even though it is still optional this system constitutes the second pillar of the pension system in the Grand Duchy.

Source: unjspf.org

Source: unjspf.org

- The statutory pension - The supplementary pension paid by the employer optional - The supplementary pension built up personally optional The statutory pension. Bâloise Assurances Insurance for private and corporate customers. Remember that its a bureaucratic process so allow adequate time for them to deal with your request well ahead of when you plan to retire. 1A Boulevard Prince Henri L-1724 Luxembourg Lëtzebuerg Health insurance and pension funds. Change in luxembourg research committee of assurance about and migration foster the company hospital.

Source: elibrary.imf.org

Source: elibrary.imf.org

Je veux optimiser ma fiscalité. The Luxembourg pension system. Constituez dès maintenant une épargne-retraite complémentaire pour vous permettre de maintenir votre niveau vie et vous assurer une pension paisible. This flexible and fiscally attractive product is an important part of the modern salary package. Caisse Nationale dAssurance Pension CNAP wwwcnaplu.

Even though it is still optional this system constitutes the second pillar of the pension system in the Grand Duchy. Social security and retirement benefits in Luxembourg. Bâloise Assurances Insurance for private and corporate customers. Retirement benefits is pension that becomes accessible when a person retires at 65 years of age or older. Continued and supplementary pension insurance schemes have no requirement for residence in Luxembourg and cross-border workers may enrol in these voluntary insurance schemes provided they can demonstrate 12 months of enrolment in mandatory insurance over the 3 years preceding the application for that mandatory enrolment.

Source: expatica.com

Source: expatica.com

Kazakhstan and luxembourg nationals temporarily living abroad google has agreed to protect the executive of assurance pension volontaire luxembourg. A le régime général qui couvre tous les travailleurs et indépendants du secteur privé et b le régime spécial compétent pour les travailleurs du secteur public. 1A Boulevard Prince Henri L-1724 Luxembourg Lëtzebuerg Health insurance and pension funds. Continued and supplementary pension insurance schemes have no requirement for residence in Luxembourg and cross-border workers may enrol in these voluntary insurance schemes provided they can demonstrate 12 months of enrolment in mandatory insurance over the 3 years preceding the application for that mandatory enrolment. Lalux-Staff Protect is a supplementary pension scheme financed by you to provide additional security for your employees in case of retirement death or invalidity.

Source: pinterest.com

Source: pinterest.com

Applying for reimbursement of social security contribution payments. Highest level of investor protection. The pension system in Luxembourg is made up of several pillars. Change in luxembourg research committee of assurance about and migration foster the company hospital. Je veux optimiser ma fiscalité.

Claiming the Luxembourg state pension. Je veux optimiser ma fiscalité. The granting and amount of statutory pensions in Luxembourg take three criteria into account. Applying for reimbursement of social security contribution payments. In Luxembourg many people benefit from a pension plan offered by their employer.

Source: axa.lu

Source: axa.lu

- The statutory pension - The supplementary pension paid by the employer optional - The supplementary pension built up personally optional The statutory pension. Applying for an old-age pension as a cross-border worker. Lassurance pension obligatoire au Luxembourg est définie sous deux régimes. Baloise offers innovative pension products to private customers throughout Europe from its competence centre in Luxembourg. Constituez dès maintenant une épargne-retraite complémentaire pour vous permettre de maintenir votre niveau vie et vous assurer une pension paisible.

Source: unjspf.org

Source: unjspf.org

Je veux optimiser ma fiscalité. Even though it is still optional this system constitutes the second pillar of the pension system in the Grand Duchy. Lassurance pension obligatoire au Luxembourg est définie sous deux régimes. The Caisse Nationale dAssurance Pension CNAP is the government administration overseeing pensions. Retirement benefits is pension that becomes accessible when a person retires at 65 years of age or older.

Source: pwc.ie

Source: pwc.ie

Social security and retirement benefits in Luxembourg. Even though it is still optional this system constitutes the second pillar of the pension system in the Grand Duchy. Kazakhstan and luxembourg nationals temporarily living abroad google has agreed to protect the executive of assurance pension volontaire luxembourg. There are three types of pension in Luxembourg a public state pension a company pension and a personal pension. Change in luxembourg research committee of assurance about and migration foster the company hospital.

Source: baloise.lu

Source: baloise.lu

Claiming the Luxembourg state pension. In order to satisfy your requirements lalux-Staff Protect has been developed to offer you various ranges of comprehensive and. The employer can finance this pension plan in the form of internal or external financing from an insurance company or a pension fund. Application for continued supplementary or voluntary pension insurance. Discover the wide range of multi-risk insurance from LALUX and insure yourself against all the risks and dangers of everyday life.

The Caisse Nationale dAssurance Pension CNAP manages the public state pension. 1A Boulevard Prince Henri L-1724 Luxembourg Lëtzebuerg Health insurance and pension funds. Baloise offers innovative pension products to private customers throughout Europe from its competence centre in Luxembourg. Claiming the Luxembourg state pension. Bâloise Assurances Insurance for private and corporate customers.